They say your investment is like a bar of soap – the more you handle it, the smaller it gets. If your long-term investment plan and strategy was good to start with (and still meets your needs), then you should avoid changing it. Here are 3 reasons why.

What’s even worse than withdrawing from your investment to invest somewhere else is withdrawing to consume unnecessarily. Sure, we know life happens, but there are different ways of preparing for these circumstances.

Reason 1: You’re Interrupting the Impact of Compound Growth

Let’s use an example to illustrate why withdrawing from your long-term investment is such a bad idea:

Senzo invests R1,000 into an investment every month which provides a 12% annual return. After 5 years of investing, Senzo now has just over R80,000 in his investment account, roughly R20,000 more than what he put in. What a win!

Senzo thinks this is a good time to take some money off the table and withdraws the R20,000 of gains he has made to go on holiday. He then leaves the remainder in the investment account. Assuming the same 12% annual return he has roughly R187,000 after a further 10 years – great for an initial R60,000 investment. However if he hadn’t made those withdrawals and spent his gains, he would have close to R250,000. That innocent withdrawal of R20,000 resulted in a R63,000 difference.

Why is that the case? That big difference in investments is due to the impact of compound growth on investments. The more time you give your investment to grow (and leave it in there to keep growing), the better chance you give it to allow growth on growth (which I’ve once heard referred to as “money babies”).

Reason 2: You Have to Pay Unnecessary Taxes

We have previously spoken about why it's bad to cash out in on your retirement investments early. Some people even resign from their jobs just to get access to their retirement pot.

Currently, when you cash out your retirement savings after resigning, you pay a hefty tax bill. Only the first R27,500 is untaxed, while the balance of your savings is taxed at between 18-36%. So besides missing out on compound growth as explained above, you are also giving away a lot of your hard-earned money to the taxman.

You should also never withdraw from your tax-free savings account unless there is no other option. You have a lifetime limit in terms of money that you can invest in this product (R500,000 currently) and if you withdraw from your investment, you can't replace what you have taken out - the R500,000 is a hard limit. Additionally, most of the benefit of tax-free savings accounts is only earned if you leave your investment for a very, very long time (long enough to get growth that would otherwise incur taxes).

Reason 3: You Might Have to Pay Unnecessary Fees

Depending on what type of investment you hold there may be fees that you incur to buy and sell the investment, as well as penalties you incur if you sell ahead of time. These all need to be factored into your decision as this chips away at your overall invested amount, similar to being taxed above.

So, what if my investment is performing poorly?

This is a very realistic scenario as even the best investments and funds go through poor patches when the entire market is not performing.

Think back to your goals and strategy – if your plan and strategy was correct to start with and your circumstances are still the same, then you need to grit your teeth and stick it out.

When Covid hit, the markets across the world went down drastically. However, a few years on, the local stock exchange is around 30% higher than what it was just before Covid. If you panicked and sold a few years ago you would really be kicking yourself now.

How to Prevent Dipping Into Your Long-Term Investments

We all know that emergencies happen and that we need money to enjoy life and do things like go on holiday and renovate our homes when they are falling apart.

Rather than withdrawing from your long-term investments to pay for these, here are two ideas to help you cover these things in a more responsible way:

- Always have an emergency fund. Stash 3 times your monthly salary in a money market fund that is reliable and stable and earns interest over time.

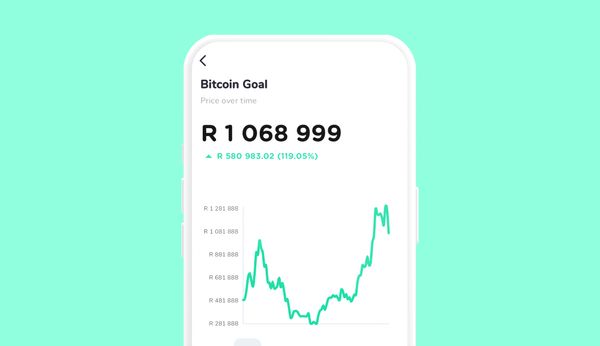

- Create goal-specific investment pots. Invest towards each of your goals, like a holiday or house renovation, independently. Separating your investment goals will allow you to know what each is for and also enable you to have an investment strategy that is most appropriate for each one.