If you're starting on the long journey of building financial freedom, you've probably come across two options: a tax-free savings account (TFSA) or a retirement annuity (RA).

They’re not mutually exclusive – you can use both – but it helps to know what each one really offers (and what it doesn’t) before you start putting your money in.

Let’s unpack it.

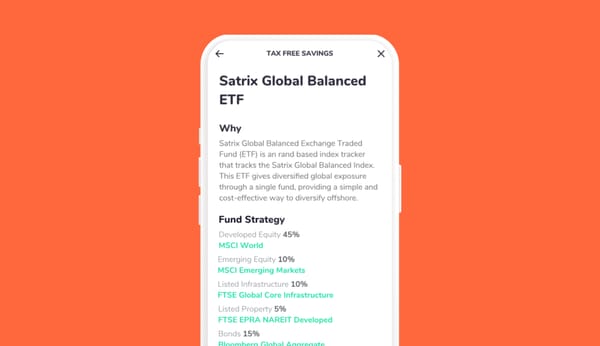

What is a tax‑free savings account (TFSA)?

A tax-free savings account (TFSA) lets you invest using after-tax money. That means you don’t get a tax break when you contribute—but the big win is this: whatever you earn, it's 100% yours when you withdraw. No tax on interest, dividends or capital gains. No strings. No limits on how or when you take your money out (aside from annual contribution limits).

There are certain limits on your contributions to a TFSA, though:

- You can deposit a limit of R36,000 a year (annual contribution limit), and

- A limit of R500,000 in your lifetime (lifetime contribution limit).

TFSAs are often recommended as a starting point because they’re simple, flexible and designed to encourage regular investing.

Who is a TFSA suited to?

If you want more flexibility and access to your money, a TFSA is a better fit than an RA. You’re able to choose which underlying fund you want to invest in (regardless of the asset mix), stop and start depositing whenever you choose, and withdraw at any time. Having said that, we recommend TFSAs for very long-term investing – without dipping into it. They are more valuable the sooner you start and the longer you leave it, as you have more time to benefit from compounding returns (and therefore more tax savings).

What is a retirement annuity (RA)?

A retirement annuity (RA) gives you a tax deduction now. You pay in before the taxman takes their slice, so your taxable income goes down and you might pay less tax this year. To be exact, you can claim up to 27.5% of your annual income (capped at R350,000/year) as a deduction on your taxable income.

But – and it’s a big but – your money is locked in until at least age 55. And when you eventually access it, you’ll pay tax again on whatever you draw down, whether it’s a lump sum or monthly pension.

Who is an RA suited to?

If you’re in a higher tax bracket and focused on long-term retirement savings rather than early access, an RA can make sense – particularly if you're building towards long-term financial freedom with tax benefits now.

How to choose: TFSA or RA?

This choice really comes down to two questions:

Pay tax now vs pay tax later?

If you’re early in your career or earning a modest income, an RA might not give you much of a boost. The tax relief you get is roughly equal to your tax bracket. So if you’re in the 18% bracket, your “savings” might be R90 on a R500 contribution. Not nothing, but not massive either—and you’re giving up flexibility for it.

On the other hand, if you’re a high earner (39–45% tax rate), an RA could offer meaningful tax savings. Just keep in mind that high earners often already have employer pension plans, which might be doing the job already.

Flexibility vs structure?

There’s this idea that locking your money away in an RA “protects you from yourself” – while you can access one third of your savings via the Savings Component once a year, two-thirds of it is locked away until the age of 55, as per the two-pot retirement system.

Sure, some people benefit from that discipline. But the better habit is building your own consistency and control – without needing restrictions to do the right thing.

That’s where the TFSA shines: it supports good investing habits while giving you the freedom to adapt when life happens.

Here’s a quick side-by-side comparison to help:

Final thoughts

TFSA or RA? There’s no wrong answer – as long as you’re doing something.

Monthly saving or investing is a habit worth building, no matter where you start. If you’re not sure, start small with what feels manageable, and adjust as you go.

Whether it's the freedom of a TFSA or the long game of an RA, what matters most is that you begin.