It's a sad reality that only 6% of South Africans are on track to retire with enough money to sustain the same lifestyle they enjoyed before retiring.

In an effort to target this problem, the government has tried to incentivise people to invest in products like retirement annuities (RAs), where you can enjoy a tax break on contributions.

In 2015, Tax-Free Savings Accounts (TFSAs) were introduced – again, with the aim of encouraging South Africans to invest and benefit from a tax break.

There are a wide range of potential TFSAs to choose from – some good and some very bad. In this blog post, we explain what a TFSA is, how you save tax on it, and how to pick the right one for you.

Want to watch and learn instead? Watch our Francly Speaking episode on tax-free savings accounts.

What is a TFSA?

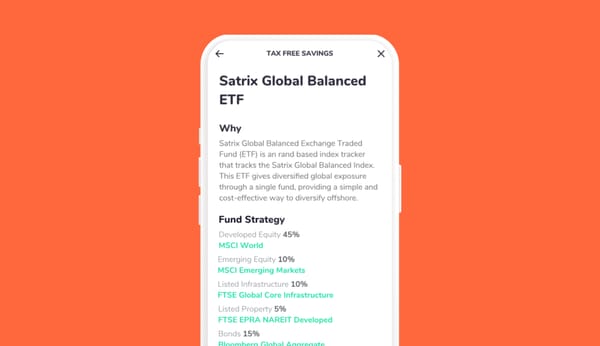

The TFSA is just a holder for an underlying fund or combination of funds. There are no restrictions on which fund you can invest your money in – it could be 100% invested in equities, for example, or 100% invested in an offshore property fund. However, the chosen fund still needs to be a designated TFSA (i.e. you can't pick any random investment and ask for it to be a TFSA).

Unlike retirement funds, you can access your TFSA at any time without penalty. That comes with a few T&Cs, however, so continue reading to learn more.

How you save tax: TFSA vs RA

With RAs, you get an upfront tax break on your contributions: your deposit is taken off your income before tax is removed. When you want to take out the money from your annuity after retirement, however, you pay tax on the monthly amount you take out as if it was a salary.

TFSAs are different to RAs: with TFSAs you invest after your income is taxed. However, you will never, ever pay any tax on that money or its growth afterwards (if you stay within your limits – see our disclaimer in the next section).

Why is that important, you might ask?

If you’re invested in a normal investment account, there are 3 main types of tax that you will or could pay that you save on with a TFSA:

- Income Tax

- Capital Gains Tax, and

- Dividends Withholding Tax (“DWT”)

This is where a big disclaimer comes in: You don't pay tax on the first R23,800 of interest income (part of Income Tax), or R40,000 of capital gains you earn in a tax year. Which means you're only really saving on tax if your investments are earning more than that on an annual basis.

The bottom line? You want to make sure the underlying fund of your TFSA is a high-growth one, which you invest in long-term to allow for compound growth to take effect.

What’s the limit on a tax-free savings account?

With RAs you can get the tax break on a maximum of 27.5% of your remuneration (your salary plus any allowances or benefits) or taxable income (the portion of your remuneration that is actually taxed) – whichever is higher – and no more than R350,000 per tax year. Which means you can contribute quite a lot.

With TFSAs you can contribute only a maximum of R36,000 per year (Annual Contribution Limit) and R500,000 in your lifetime (Lifetime Contribution Limit). If you go over any of these limits you will have to pay a 40% penalty, so best to keep within them!

TFSAs are for very long-term investing

TFSAs in itself were a great initiative and have great benefits if used properly. One thing I don’t think the government got right though was the name: saving is something that you do with the ultimate aim of short-term consumption: putting money away for a holiday, your emergency fund, or a pair of shoes, for example.

TFSAs, on the other hand, are meant for extremely long-term investing and are best suited to equity investments which are volatile in the short term, but have historically shown good growth over the long term. It makes my blood boil when I see companies advertise TFSA investments into interest-bearing products.

This is NOT where your TFSA contributions should be going, given the R23,800 tax exemption mentioned above. If you think about it, you could have around R300,000 in a money market fund at today's rates and not pay tax, so why use your TFSA for this?!

Do's and don'ts of TFSAs

There are three other important things to know about TFSAs that will help you make the most of them:

❌ Don't use it like a savings account. You can withdraw from TFSAs at any time, however any withdrawal does not increase either your Annual or Lifetime Contribution Limit described above. So let’s say you made a R36,000 investment into a TFSA on 1 March 2023 and then withdrew R10,000 on the 15th March 2023. This doesn’t mean you can reinvest R10,000 later in the tax year. Once you hit your annual limit, that’s it.

✅ Do keep track of your TFSAs. You can also have multiple TFSAs if you really want to, but the Annual and Lifetime Contribution Limits apply to you as an individual, and not to each account. So if you have more than one TFSA, you need to make sure you keep within your annual and lifetime limits.

❌ Don't withdraw and deposit into a new TFSA – rather transfer. If you aren’t happy with your existing TFSA for whatever reason, you can transfer it from one provider to another, but just make sure it is a ‘transfer’ and not a ‘sale’. Ensure that your asset manager or investment platform is the one who is transferring the existing TFSA value to your new provider and that the money never goes through your bank account. Because if you sell it and then reinvest it yourself (even if into another TFSA), your limits explained above would be impacted.

Is a tax-free savings account worth investing in?

Yes, definitely! Do your homework and compare fees, risk profiles and growth potential, and invest in the right products which have low fees. Then don’t touch your money unless absolutely necessary – this is the only way that you will properly benefit from the compounding effect of your returns that you don’t need to pay tax on.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)