Investing is essentially a balance of risk and return: deciding how much risk you’re willing to take on for a certain expected return. In this blog post, we explain why taking on a certain amount of risk can be beneficial in investing, and how to decide how much investment risk is right for you.

What is investment risk?

Risk is linked to being uncertain of an outcome. In the case of investing, you might be worried about losing some or all of your hard-earned money.

Different investment products have different levels of risk. For example, if you invest in a fixed deposit – which is really a savings account with a fixed interest rate and minimum period where you can’t access your money – you know exactly what you're going to get out at the end of the investment term. The outcome is certain.

But if you invest in shares, the outcome is less certain. At the end of a defined period – especially a shortish period (less than three years) – your money could be worth a lot more… or a lot less. That’s because the share market goes up in the long run, but in the short term it bounces around a fair bit.

For investors (as opposed to traders), the secret to making money from shares is to stay in the market for a long time and to exit when market conditions are favourable (not when circumstances dictate).

Risk vs return

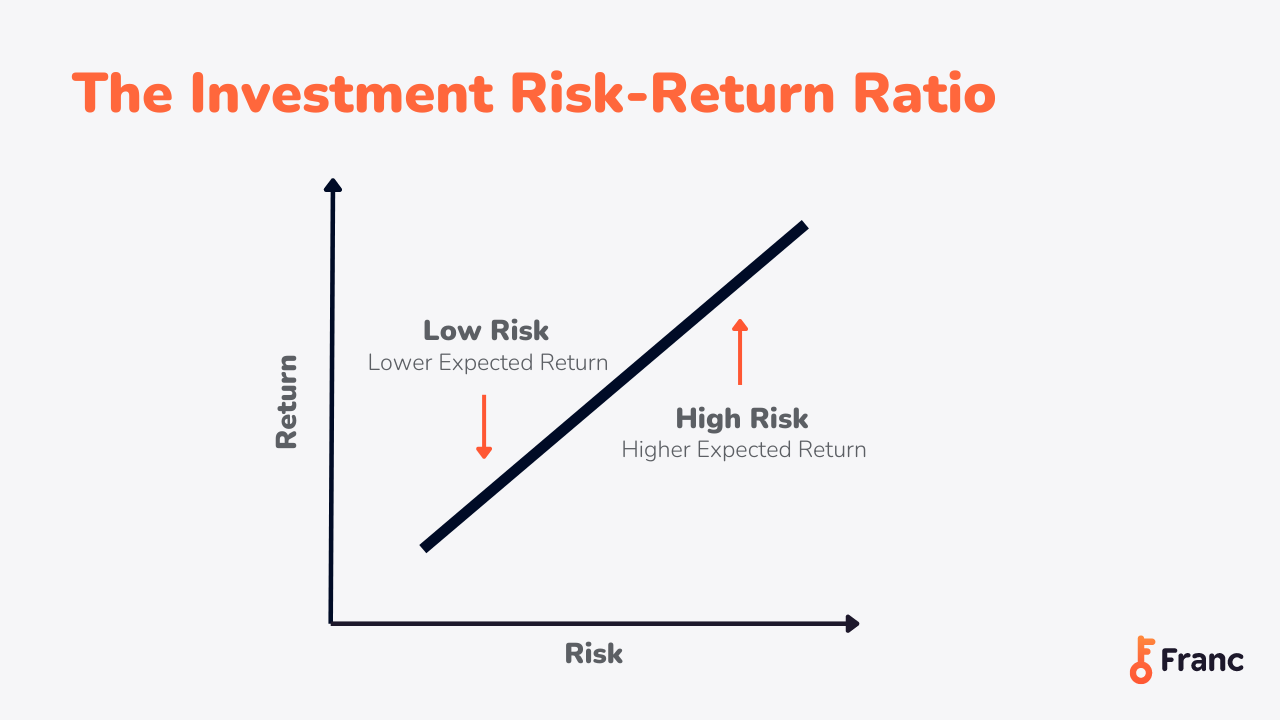

Investment risk is one of the cornerstones of investing. The other cornerstone is expected return: how much growth can you expect from a particular investment. Combining these two concepts together is what is referred to as the risk-return ratio: how much investment risk you’re willing to take on for the expected investment return.

As you can see from the graph, typically higher risk implies higher expected returns – but not always.

Although investing is about finding the right risk-return ratio that suits your investment goals, personal finances and time horizon, sadly too many people don’t take investment risk into account and simply focus on the size of the potential return. I mean, who doesn’t want to get rich quick, right?

If you had some spare cash, you might consider gambling on a sports bet or buying a lottery ticket, because even though it’s high risk, the returns can be huge. Sadly though, this is not the case because when you do the maths, the expected return is actually very low, or negative.

Of course, your reaction might be that you simply want to avoid risk altogether.

But this is where things get tricky. Risk-free investments, like fixed deposit savings accounts, are associated with a different kind of problem – low growth and poor rates of return. Money in a savings account grows very slowly.

But isn't a slow return better than taking on risk, you might ask?

While there is no one answer to this question, the fact is that it's very hard for most of us to grow our wealth meaningfully if we only invest in risk-free products. Many risk-free products actually underperform inflation, meaning that our savings are not even keeping up with the cost of living.

Investment products with slightly higher risk, on the other hand, like shares, offer the prospect of higher rates of return – but they're not called risk products for nothing; there is also a chance of losing money.

How to lower your risk in investment

So the real question is how do you minimise investment risk while still ensuring that your money grows and that inflation doesn’t eat into your savings?

The two key things to consider here are the time horizon and diversification of your investment:

1. Lower your risk by leveraging time

The reason why time is so important is because in investing, prices can go up and down in the short term. This happens because most investments are traded in an open marketplace where the price is determined by negotiation between a willing buyer and a willing seller on a day-to-day basis.

If you can afford to hold onto an investment for long enough without selling, you can ride out the investment's short-term price fluctuations.

2. Lower your risk through diversification

Another common way of reducing your investment risk is through diversification: not putting all your eggs in one basket. Practically, this means investing in different types of investment asset classes, such as property, equities and cash.

That’s because if you spread out different types of investment risk by investing in different assets, you reduce your overall risk because the chances of something bad happening to all those different asset classes at the same time is very unlikely. If the value of one drops, the other is likely to stay stable or maybe even go up.

What’s the right risk-return ratio for you?

Deciding how much risk is right for you involves two factors:

- Your financial capacity to hold onto your investment without needing to sell. When it comes to higher-risk investments, keeping your investments over a long period of time (5 or more years) helps ride out fluctuations to give yourself the best chance of earning a good return. If you don’t have an emergency fund to fall back on though, you might be forced to dip into that investment earlier.

- Your tolerance for risk. It's important to be realistic about your personality – if you're a nervous person that stresses every time the market falls, you might want to take on less risk than your financial situation allows.

To sum up, we all want to get rich quickly with very little risk, but remember that wealth can take a lifetime to build and a second to lose. Investment risk is real. Protect yourself against the risks by thinking carefully about the risk-return ratio that is right for you and where possible, spread your investments out over different types of asset classes.