With unemployment at record levels, more and more adverts promise big profits from forex trading.

As soon as you search for anything to do with investment you start getting ads for forex training courses, trading systems and platforms.

You can make thousands of dollars a day, say the ads, even if you only have a small amount of money to trade with.

The prospect of such quick returns is tempting.

Betting on Exchange Rates

What, exactly, is forex trading and how does it differ from buying shares or unit trusts?

'Forex' is short for 'foreign exchange' – transactions where one currency is bought and sold using another currency. Buying euros with rands before you travel is a forex transaction.

Global trade has turned forex into a huge market where trillions of dollars are exchanged every day.

In one sense, forex trading is much like any other kind of trading – you buy at a price with the intention of selling at a higher price. For example, if you buy dollars with rands before an overseas trip at R15 per dollar, and when you get home you sell your leftover dollars back to the bank at R16 per dollar, you have made a R1 per dollar profit on the cash you didn't use.

Of course, forex traders are not buying and selling physical currency. Instead, they're trading 'on margin,' which means taking large positions against small deposits. It's a bit like buying a R1m house with a R100,000 deposit – the rest of the money is provided by the bank. But you're on the line for the value of the property, not just your deposit. If the property market falls and you sell the house for R900,000 all of that goes to the bank and your deposit is gone. This is called 'leverage' or 'gearing' – a 10% drop in the value of the asset means a 100% loss for you.

This is exactly what makes forex trading very dangerous.

In the house example above, the gearing multiple is ten. If the property market goes up and you sell for R1.1m you are left with R200,000 after repaying R900,000 to the bank. The house price went up 10% but you made a 100% profit on your deposit.

In the forex market the gearing multiple can be as much as fifty. Which means it's easy to make money… and equally easy to lose money.

The Zero Sum Game

It's important to understand that forex traders do not buy assets. They don't even buy currencies. What they do is take bets against each other on the direction of foreign exchange rates.

In a forex trade you are literally betting against someone else.

Some people argue this is also true if you buy shares or a fund like Satrix 40. After all, surely you only sell if you think the value is going to fall? And surely the person who buys thinks the value is going to rise? And only one of you is right. One winner, one loser.

But there is an important difference.

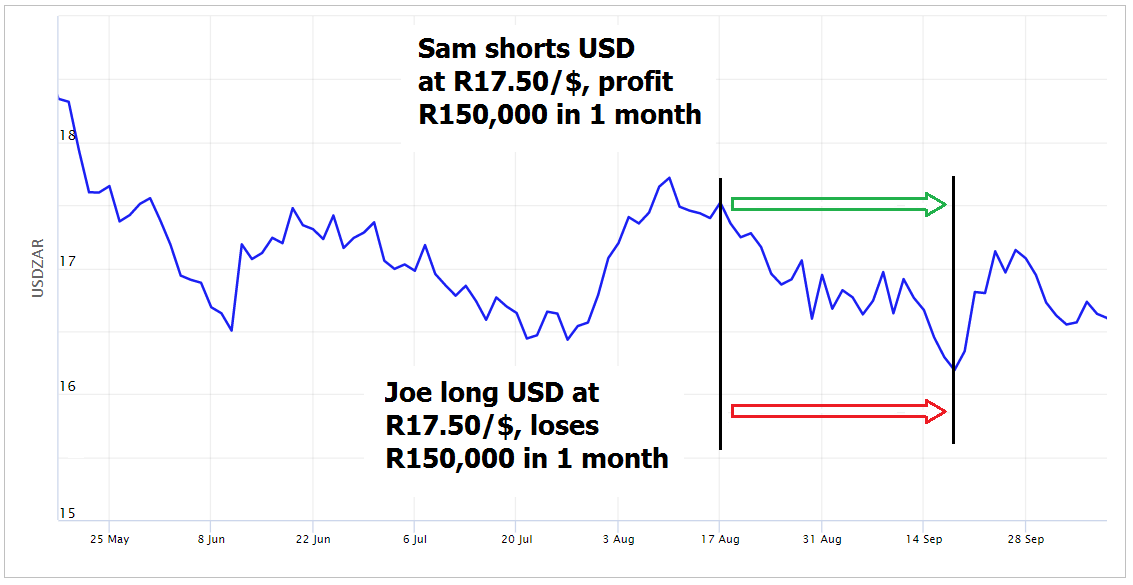

When you buy shares or a fund you actually own the underlying asset. The asset has intrinsic value and pays dividends. In the forex market, on the other hand, you don't own anything, you just take a bet. If you bet on the price going down (eg, the USD/ZAR rate going from R17 to R16) you are called the short. If you bet on the price going up you are the long in the trade.

A forex trader going short is betting the exchange rate will fall. Profit is dependent on the rate going down. The person on the opposite side of the trade, the long, is betting the rate will rise.

But when you sell an asset you are not necessarily betting on the price going down – you and the next buyer are not necessarily on opposite sides of the trade.

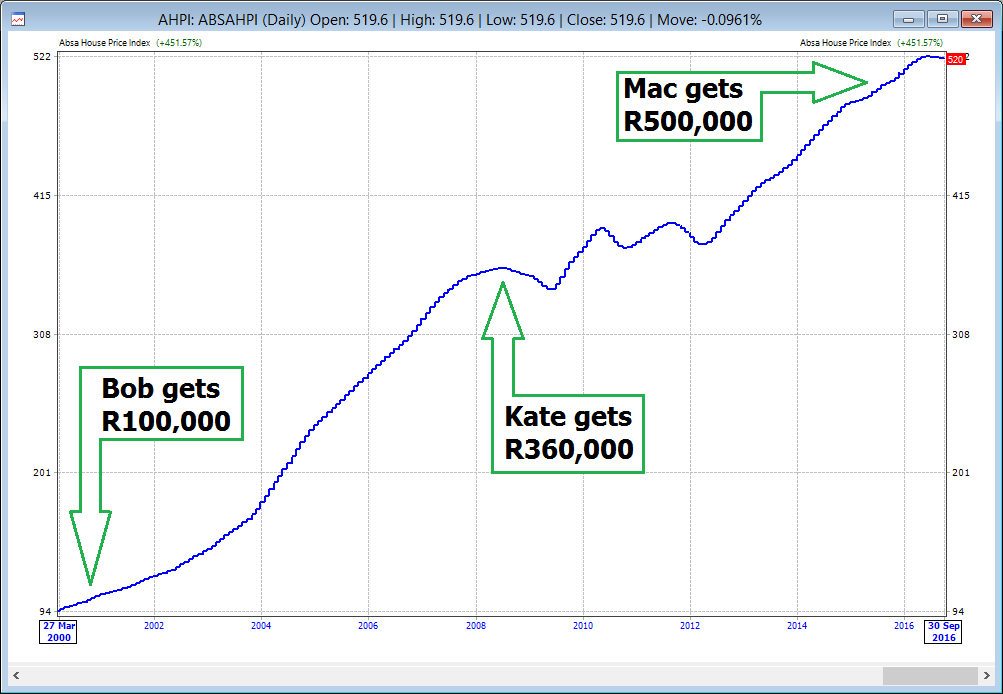

Consider this example using the Absa house price index. Builder Bob constructs a cottage and sells it to Kate for R100,000. Bob, as a developer, makes a profit. Eight years later, Kate wants to move to a bigger house so she sells to Mac and makes a profit of R260,000. Seven years later Mac decides to emigrate and sells for R500,000, making a R140,000 profit.

In this example, each person makes a profit and nobody sells because they think prices are going down. Kate and Mac are not really on opposite sides of the trade, they're both 'long' property. But when it comes to forex, a sell means you are betting on the price going down and you take the short side in direct opposition to someone who thinks the price is going up. It's a brutal game.

For every rand you make someone else has to lose a rand. That's why it's called a zero sum game – the profits made by all the winners combined exactly equals all the losses made by the losers.

Investing vs Speculating

Are there people who make money from forex trading? Sure, there are a few talented individuals who consistently make profits. But the vast majority of people who try forex trading end up losing money or, if they're lucky, breaking even.

Think about it – it's a 50/50 game. At every point in time, half the players are losing and the other half are winning.

If you're thinking about forex trading, ask yourself this: what makes you think you can beat the 50/50 odds? Are you more clever than most people? Are you more disciplined? Is your system better?

The talents of successful traders include tremendous self-discipline, huge consistency (every day, watching the ball all the time, sticking to pre-defined rules), and a solid understanding of the markets. Unless you have these talents in abundance, save yourself a buck and stick to investing – speculation is for a rare breed of human.

And there's another reason to focus on investing. When it comes to assets like shares and property, the odds are actually stacked in your favour.

Look at the graph of the Absa House Price index again. There are dips, of course, but over time house prices go up. It's the same with the stock market. There are crashes and retractions, but I can guarantee you that in ten years the JSE All Share Index will be higher than it is today.

Shares also pay dividends and property can earn rental income, which gives both an intrinsic value.

In a nutshell, buying decent quality assets puts the odds in your favour, whereas trading forex is like tossing a coin. Unless you have some secret formula or hidden talent that the other ten million people trading forex do not have, your odds of winning over time are exactly 50/50.