Despite all the political and social challenges facing our country, this blog is not about Gandhi’s passive resistance political movement. Rather, it's about a growing resistance in the market to passive investing.

Passive investment is any investment in financial products that doesn’t require a money manager to make regular investment decisions on behalf of the investors. Instead, the investment decisions are based on a predetermined combination of assets, where decisions to buy or sell are governed by an algorithm.

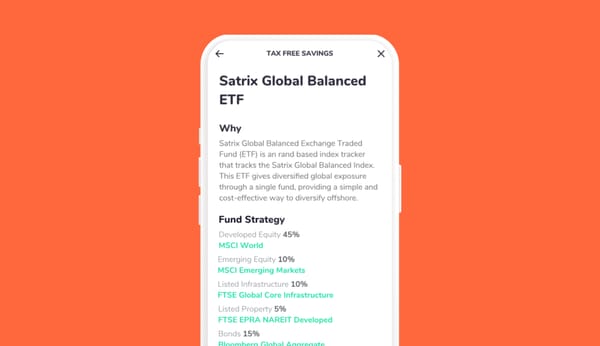

A simple example of this is an index-tracking equity fund, like Satrix 40 ETF - an exchange traded fund that tracks the top 40 companies on the Johannesburg Stock Exchange.

The criticism of passive investment, particularly index-tracking funds, can be described as follows:

- Passive investing tends to distort the prices of individual stocks, because everything is bought in a fixed ratio without considering the value of each company.

- Indices that include options and derivatives can break under stress and cause money losses or more volatility.

Overall, I disagree with these criticisms, but as with many things the reasons for this are complicated:

- The assumptions here are that all indices use the same algorithm and that there would be no (or few) willing buyers or sellers for a trade. Both of these assumptions are false. Not all indices are the same and passive investment is only 45% of equity investments in the United States and 18% of global equity investment. This means that it's unlikely in the near term that there won't be a market for passive investment trading.

- This criticism only applies to synthetic indices, i.e. where actual shares are not bought and sold by the fund managing the index. Rather, the performance of the index is replicated by trading in financial derivatives. Synthetic indices are indeed a load of rubbish, which is why all indices are not the same and it's always worth making sure that you're making a smart choice before you invest.

Passive investment is shaking up the investment market. Given that passive investing has dramatically lower fees than active management (in many instances several order of magnitude less, e.g 0.01% versus 1%), it's likely that this resistance to passive investing is driven mainly by a loss of income by active fund managers.

So don't be fooled. Unless you are investing with Warren Buffett's Berkshire Hathaway, with its envy-inducing $345,880 share price on 2 December 2020, for most of us, tracking the best of the equity market through a low-fee ETF is the smartest way to invest.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)