“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

- Warren Buffett

While Forbes lists the top five qualities every investor should have as; talent, intellect, knowledge, common sense, and a bias towards action - an essential quality that is missing from this list is PATIENCE. It is one of the most underestimated investing traits, and not everyone has the discipline to invest now and forget about it. There exists those investors that become too focused on the hourly changes in market prices. These investors look to profit from quick investments rather than finding long-term opportunities that may overcome short-term share price volatility. An investor, who buys and sells their shares quickly after so that they can (hopefully!) realise short-term gains is known as a day trader.

In South Africa, day trading is quite popular amongst the youth and has grown significantly since the start of the pandemic. At the outset, day trading might seem like an attractive way to make money, since it is more likely that an investor would sell their shares at a point in the day when the share price has increased and therefore make a profit. However, movements in share prices are unpredictable and can go down instead of up. Continuous trading also incurs large amounts of fees, transaction costs and sometimes taxes on the sale of shares. However, many people are still attracted to the facade of day trading due to the influx of “social media traders”. (Cue the Instagram DM’s of “I turned R100 into R10 000 in 1 day, are you interested?”)

Day trading may be considered akin to gambling as generally there is a 50/50 chance of profit or loss. Some of the other more significant risks include becoming indebted, whereby day traders find themselves in debt due to over-trading or taking leveraged positions which go the wrong way. Another risk of trading is the scam broker risk, where day traders can become scammed by other fake or rogue brokers, which makes it difficult to withdraw any profits.

Day traders have to be experienced, quick thinkers, and have great skill to monitor market conditions and performance of several companies at a time to earn that quick buck – which means that day trading is only efficiently executed by professional full-time traders (who often get it wrong themselves). Although day trading suggests quick returns, it is very challenging for investors to make continuous profits.

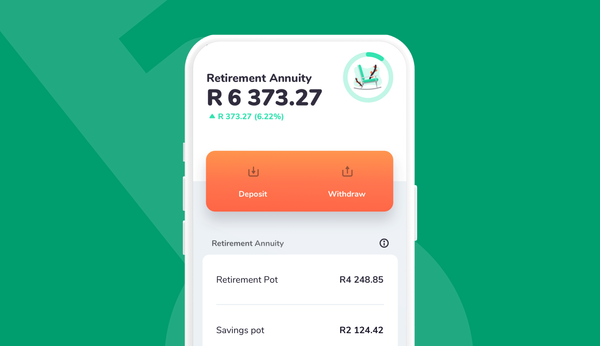

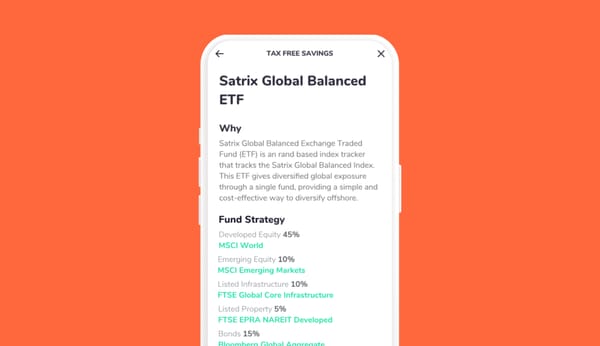

Whether you agree with Warren Buffett or not, it is hard to overlook some of his notable investment advice. The most exciting concept that he mentioned includes the “20-slot” rule. Briefly put, he presented the idea of giving a potential investor a card with twenty punch slots, similar to those you get at a local coffee shop. The twenty slots represent the number of investments you can make in your lifetime. With only a few investments, it requires you to think strategically and become more selective with where and how you invest. Instead of putting your eggs all in one basket, you can carefully plan out the investment process to generate returns. Unlike day trading which would use up all twenty slots in a single day, investing for the long term provides a more fruitful and generous return, if only you remember to be patient. With your Franc account, you get the benefits of choosing forty investments but only using one (diversified!) slot through the ETF option. Just remember to always be patient if you are looking for long-term wealth.