We’ve probably all heard we should save money over the course of our lives – but that’s easier said than done. Some people aren’t able to save because any disposable income they have goes to paying off debt, while others can’t save because they simply don’t have enough disposable income left at the end of the week or month to put away.

There are also those who don’t save because they struggle to keep up the discipline or motivation, or lack a reason to save (but trust me, there’s always a reason to save!).

What is saving, and why is it important?

Saving is the act of putting money away so that you have a larger amount available at a future date – either for a specific goal (like a deposit for a car or your child’s education) or just in case of an emergency (like when that same car breaks down and you need to replace its engine!).

Saving means you have cash on hand when you need it – which helps you avoid debt. When you elevate your saving into investing, you’re also earning interest or dividends on the money you put away. This can grow significantly over time, which becomes a source of passive income for you and your family.

Unfortunately, research has shown that many South Africans aren’t saving or investing: according to the 2023 Financial Literacy Baseline Survey, 44% of respondents stated that they weren’t actively saving, and a third of respondents had no retirement plan.

So how can we improve the savings and investing culture in South Africa? Enter savings challenges: they not only help you stick to your savings goals, they also make the whole process more fun.

What is a savings challenge?

Savings challenges have really had their time in the limelight lately, in part because they’re popular with savvy financial content creators, like Ess Mukhumbo and Soul Fairy. A savings challenge is essentially a savings plan that has certain ‘rules’ and timelines you need to follow, like a game. For example, a popular savings challenge is the 52-Week Savings Challenge, which lays out a plan to save R100 in the first week, then increases your deposit by an extra R100 every week until the end of the year.

2024 #R350Savingschallenge is here 🎉💃🏽.There is two options

— Ess (@EMukumbo) December 27, 2023

Option 1 we save R350 every Friday, 1st Friday of the year starts on the 5th of January 2024, total savings=R15400.

Option 2 we save monthly but increase contributions by R350 every month, total savings= R23100 pic.twitter.com/MN6ai2IdeC

Another great thing about a savings challenge is that it maps out exactly what you need to save over time, and how much these savings accumulate to, so you can plan ahead and budget your finances. Savings challenges accomplish two things: the most obvious is that your savings increase, and the second and perhaps most important aspect: you get to build the habit of saving.

6 South African savings challenges to try out [+ downloadable saving plans]

Here are 6 South African savings challenges in rands that will help you improve your savings habit:

- The Fixed 52-Week Savings Challenge

- The Increasing 52-Week Savings Challenge

- The Reverse 52-Week Savings Challenge

- The Fixed 12-Month Savings Challenge

- The Increasing 12-Month Savings Challenge

- The Reverse 12-Month Savings Challenge

*Note that all interest calculated in the templates assumes you are investing your savings on the Franc app with a Very Safe (100% cash) investment strategy. The interest assumption is based on performance at time of publishing and is not a guarantee of future performance.

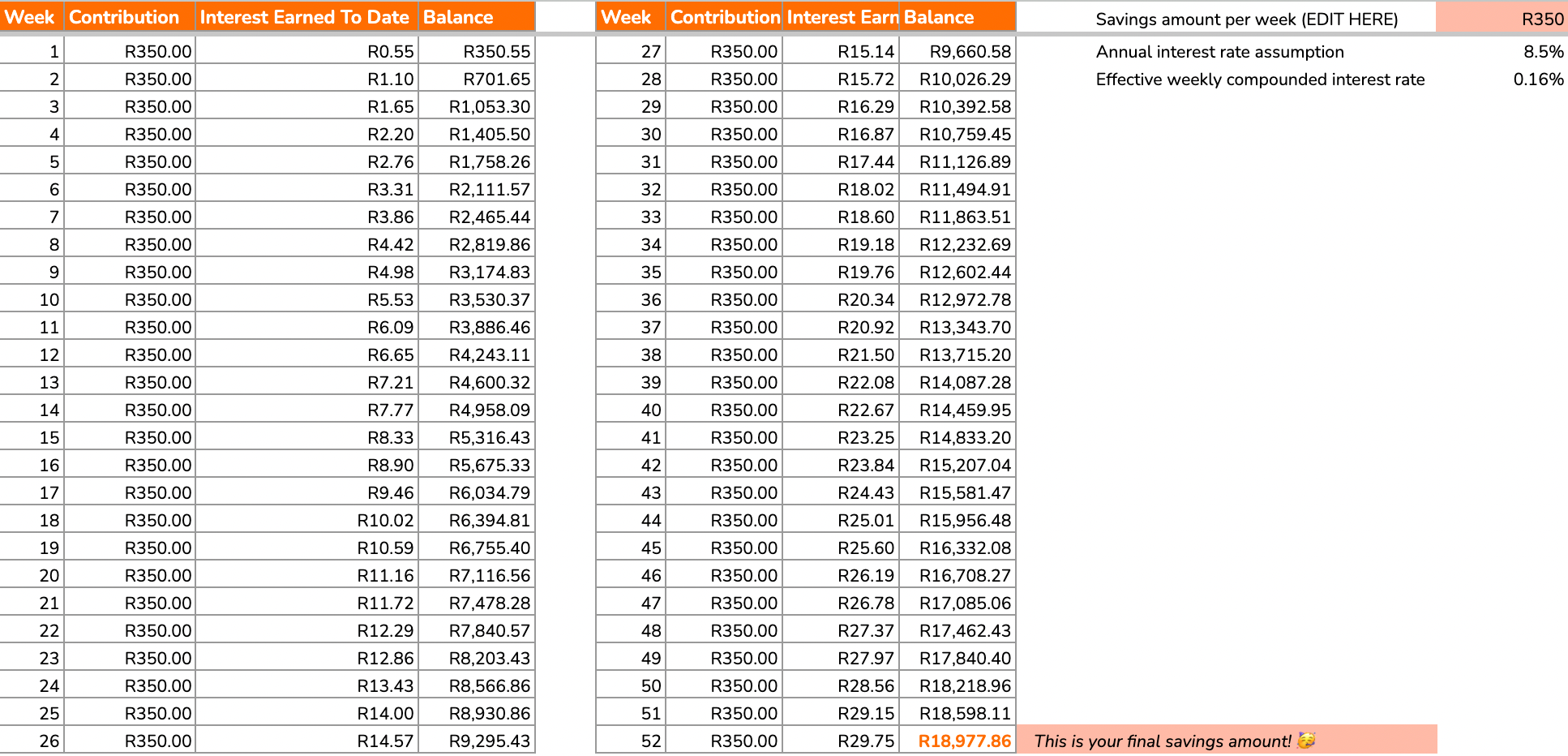

1. The Fixed 52-Week Savings Challenge

If you need to deposit smaller amounts, regularly, and keep up a steady momentum to keep your motivation for savings going, the fixed weekly savings challenge is for you. It challenges you to deposit a certain fixed amount (like R100, or R350 – whatever you feel comfortable with) every week for 52 weeks.

⬇️Download the Fixed 52-Week Savings Challenge Template

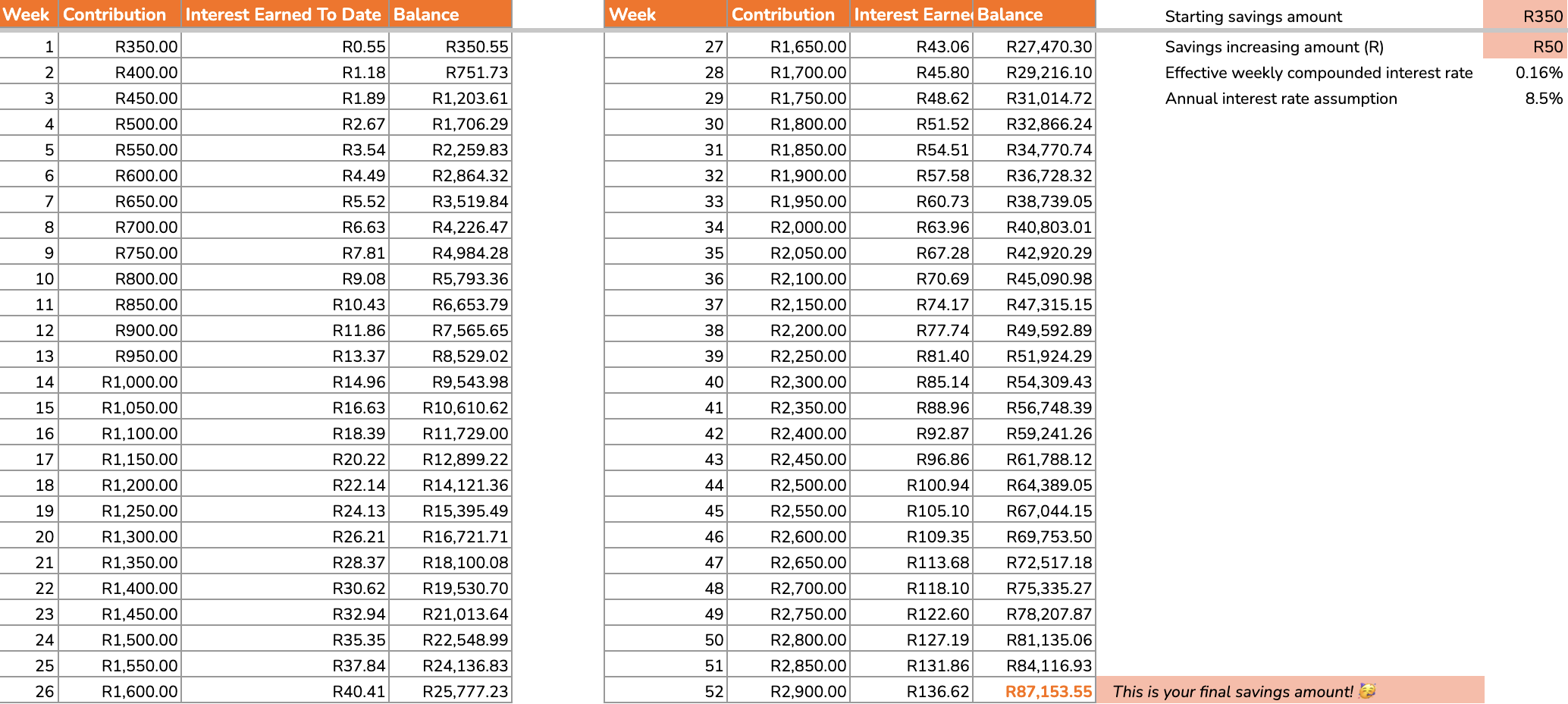

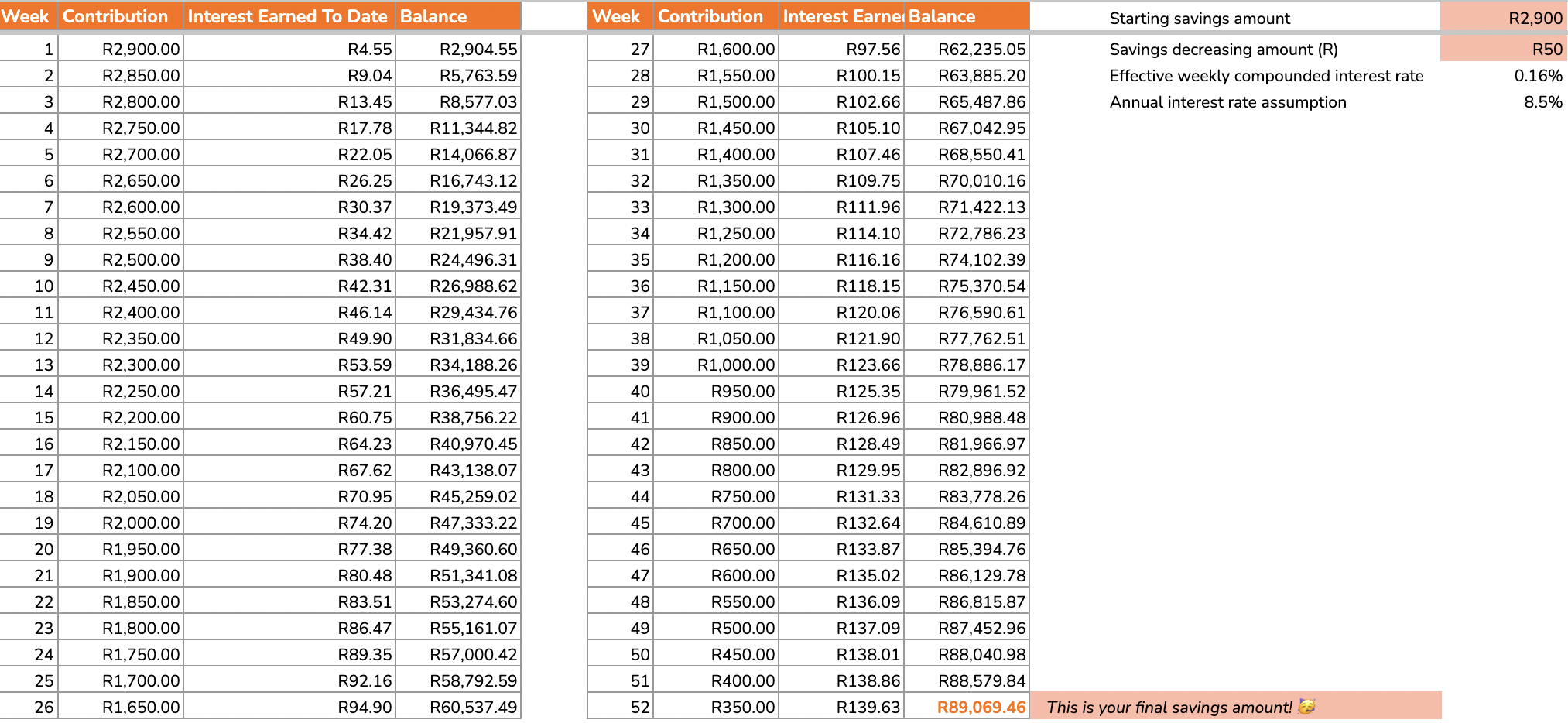

2. The Increasing 52-Week Savings Challenge

This weekly savings challenge helps you build a regular savings habit, but with a twist: every week the amount you need to deposit goes up by a certain amount (like R50). You might be crying at the end, but you’ll have a nice stash saved for your goal!

⬇️Download the Increasing 52-Week Savings Challenge Template

3. The Reverse 52-Week Savings Challenge

The Reverse 52-Week Savings Challenge follows the same rule as the Increasing Savings Challenge – only in reverse. You might start by saving R3,000 in week 1, but you end off only paying R450 at the end.

Not only does the reverse savings challenge get easier and easier, it also earns you more interest. Why is that, you ask? Your interest is earned as a percentage of the total amount you have in your account. If that amount is larger at the beginning, the interest is higher. And the beauty of investments is that you earn compound interest, which means the next month, you’re not only earning interest on the amount you deposited, but also on the previous month’s interest you earned. And because that initial deposit and interest was quite large, your month-to-month return is considerable, and growing, too.

⬇️Download the Reverse 52-Week Savings Challenge Template

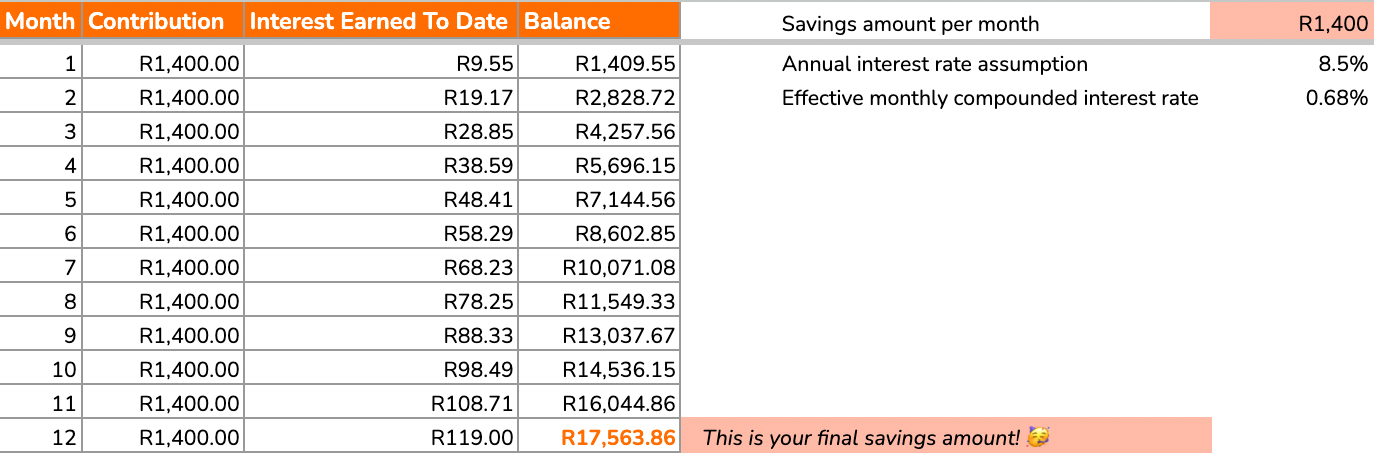

4. The Fixed 12-Month Savings Challenge

Does a weekly savings challenge seem a bit too hands-on for you? Then a monthly savings challenge is exactly what you need! Stick to an amount that works for you (or use our online budget tool to figure out how much you can afford every month), set it in the template and get saving every month.

⬇️Download the Fixed 12-Month Savings Challenge Template

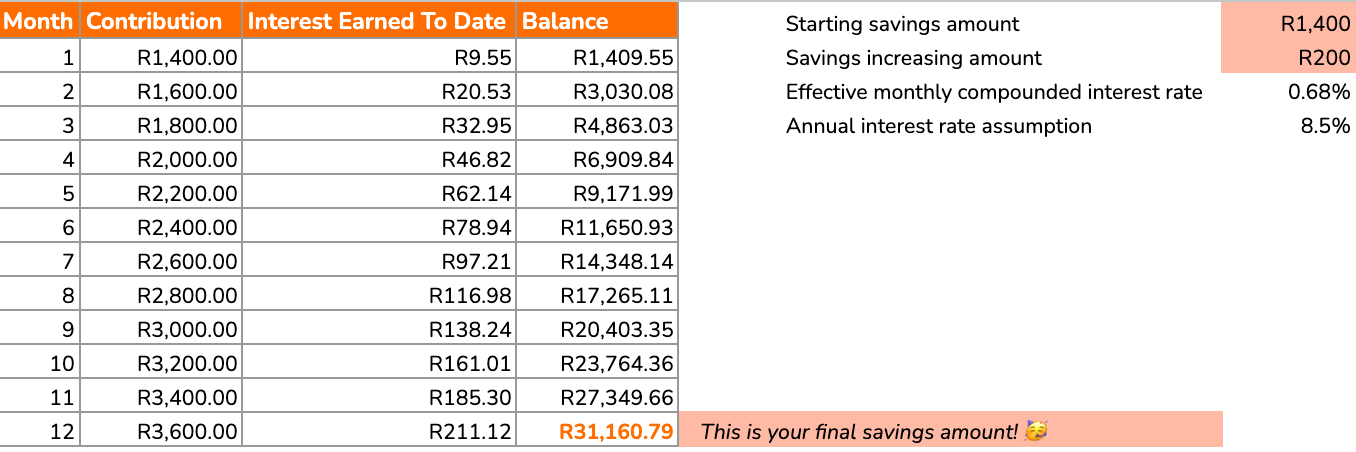

5. The Increasing 12-Month Savings Challenge

The Increasing 12-Month savings challenge takes the traditional monthly savings challenge up a notch: your monthly deposits increase by a certain amount month-on-month.

⬇️Download the Increasing 12-Month Savings Challenge Template

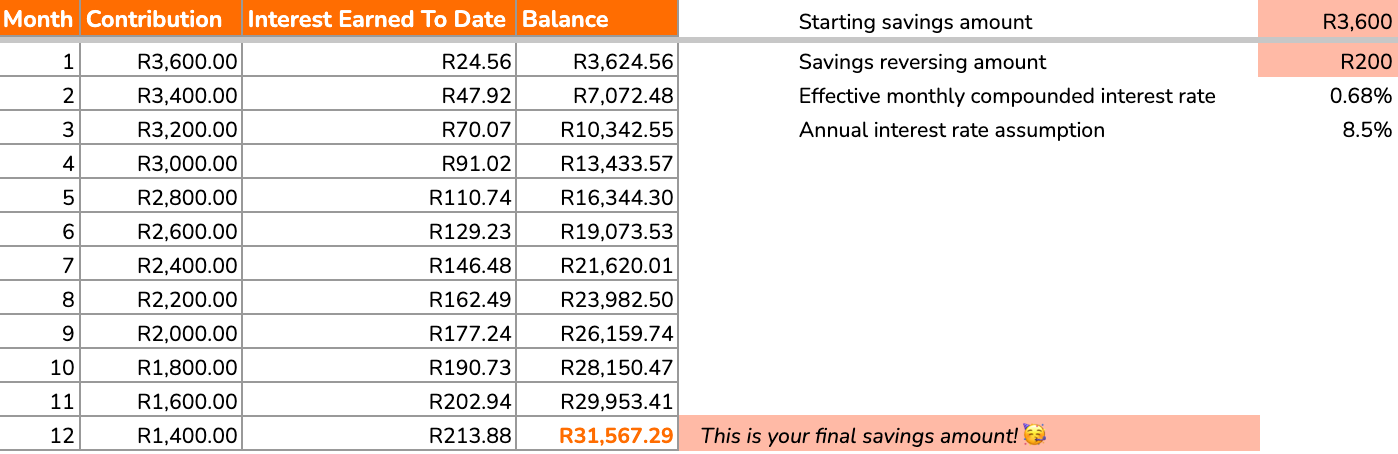

6. Reverse 12-Month Savings Challenge

The Reverse 12-Month Savings Challenge is a fun monthly savings plan to challenge yourself to, with the added benefit of extra interest based on your initial big deposit amount. Plus, you’ll be cruising into your final savings amount at the end of the challenge!

⬇️Download the Reverse 12-Month Savings Challenge Template

4 Tips to setting up a savings challenge on the Franc app

If you’re looking to start a savings challenge using your Franc account, then follow these tips to make it way simpler for yourself:

- Set up an investment goal. A goal means you know what you're saving or investing for – and it helps you keep up your motivation whenever you check your balance. When you sign up on the Franc app, or when you set up a second goal, you’ll immediately be asked to choose a goal.

- Set up a deposit reminder. Don't rely on your memory to keep up with your savings challenge: set an automated reminder instead. You can set a deposit reminder via the Profile tab for the day of the week or month you want to make your deposits, or set up a stop order in your banking app. Automation and reminders help you stick to your new habit!

- Lock your goal. If you feel you might get tempted to take out money at the slightest inconvenience (like changing that coffee order from a short to a tall) then consider locking your goal for the duration of your savings challenge. You can do this by clicking on ‘Edit’ in the orange bar on your goal dashboard and then setting the date for your goal to unlock.

- Join a Savings Challenge on the Franc app. Every few months we have a month-long savings challenge where you can stand the chance to win a boost to your investment in a lucky draw. If you're saving already, it's a great way to get some extra motivation and boost your efforts! Check the Boost tab regularly to see what challenge we're running.

![6 Savings Challenges to Actually Stick To [+ downloadable savings plans]](/blog/content/images/size/w2000/2024/01/6-Savings-Challenge-Templates-to-Download-1.png)