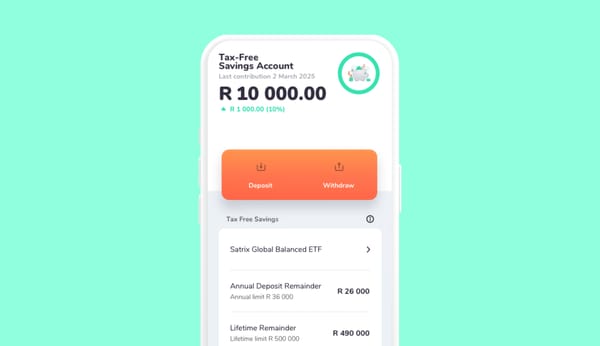

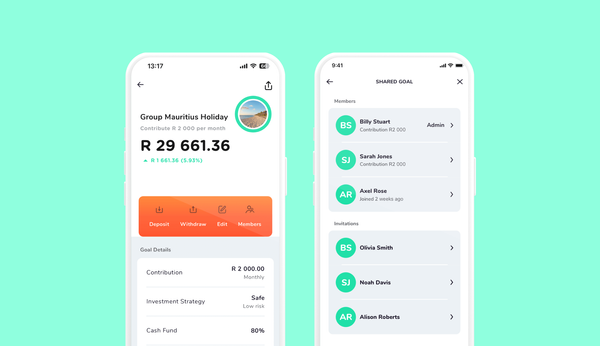

On 27th January in 2017 I registered Franc via the Companies and Intellectual Property Commission’s (CIPC) website. At that time, I had little more than grand plans on radically changing how people think and interact with money. Although that ambition hasn’t changed, we’ve focused on helping people grow their wealth by making investing easy and accessible.

When I started thinking and researching in 2017, I was astounded to learn that South Africa was the highest country in the world for the search term “how to invest” on Google trends. Beating out countries such as Singapore where half the population invest in the stock market, compared to about 5% of South Africans. That always struck me as incredible. Interestingly, South Africa currently sits 3rd in the global rankings for the same search term today.

Over the past 5 years the financial industry has seen a lot of change. The greatest change has been observed in Europe, which was the first region in the world to implement open banking - basically the ability for 3rd parties to access banking information and submit payment instructions via API with consent from banking clients. This regulatory innovation saw an explosion of fintech platforms and services across the region. The US followed suit in 2018.

In the wealthtech space, the US platforms like Betterment, Wealthfront, Acorns and Robinhood have been hitting their stride by enabling millions of new investors to access investment products. Robinhood had their IPO last year whilst Wealthfront was acquired by UBS in January 2022 with Acorns and Betterment both achieving unicorn status (valuation over $1 billion).

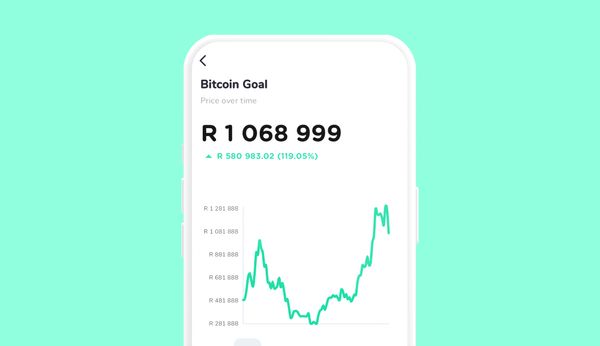

Looking at the local fintech ecosystem, there has been a lot of activity. Franc was accepted into AlphaCode in 2018 and we remain an active member of the community there and are very grateful for their ongoing support. Naked and Pineapple are reinventing insurance, whilst Luno and VALR have capitalised on the surge of interest in crypto trading. EasyEquities have continued to grow strongly and expand access to the stock market. We’ve also seen a few key partnerships in the fintech space, specifically Lulalend partnering with Vodacom to help small business owners access credit and Capitec banking clients access stock trading through EasyEquities.

On the down side, the FSCA’s fintech sandbox, which formally launched in August 2017 has yet to realise its full potential and had a few teething issues that resulted in a few companies having to shut down, notably JupiterSave and Nobuntu. In November 2020, the South African Reserve Bank (SARB) issued its “Consultation paper on open-banking activities in the national payment system”. Sadly, since then there has been little to no forward momentum in that regard. That has not stopped platforms like Stitch from establishing relationships with incumbent banks to open access to payment and banking services via API.

Looking across the continent the African fintech sector has seen tremendous growth, with 4 of Africa’s 5 unicorns being fintech companies. The African fintech companies also dominated fundraising on the continent; raising over US$1 billion, just short of half the total raised by African startups in 2021. There have also been major partnerships, most notably Stripe’s acquisition of Paystack, a Nigerian payments company for over $200M.

The African wealthtech space has also seen a lot of activity, with Nigerian Cowrywise and Piggyvest seeing tremendous growth in Nigeria whilst Thndr saw strong growth in Egypt and recently closed a Series A fundraise of $20 million.

Nevertheless, there is still a lot of room for growth with less than 5% of Africans investing. So all I can say is that I hope the next 5 years sees Franc, as well as the African fintech scene, continue to go from strength to strength!