At the start of a new year most of us are full of new year’s resolutions. One of the most common resolutions is to be smarter with money, evidenced by the fact that South Africa is the top country in the world for the search term how to invest.

But before we get onto the how let’s start with the why.

Why invest? It may seem like a simple question, but the answer is actually more complicated than many people think.

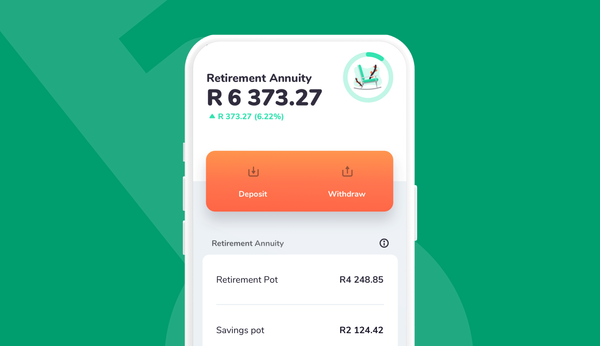

Most people are happy with themselves if they are able to put some money aside every month. The problem is there’s a big difference between feeding the piggy bank (that is, saving) and making money work for you (that is, investing). Let’s define investing as the process of acquiring assets that put money in your pocket while you’re sleeping.

Ok, so now that we’ve differentiated between saving and investing, let’s go back to the question of why it’s important to invest. The main reasons are four-fold:

The most important reason to invest is because money loses its value over time. Inflation is the term given to the rate at which your money loses value over time. So the first and perhaps most important reason to invest is to ensure that the money you save grows in value instead of losing spending power (to understand more about inflation you can read our blog post about why inflation matters).

The second most important reason is that asset growth rates, on average, exceed the growth rates of salaries and wages. In other words, in percentage terms over the long term your investments are likely to grow faster than your salary. This powerful insight was highlighted by French economist Thomas Piketty in his monumental book Capital in the Twenty-first Century (2013). It’s because of this, that famous authors like Robert Kiyosaki in his best-selling book Rich Dad, Poor Dad (1997) emphasize that most poor and middle-income families, who work for their money, should emulate wealthier households, who make their money work for them.

Thirdly, compound growth is one of the most powerful ways in which money can be put to work. This is when investment returns are reinvested. Investment returns are a bit like free money; compound growth is when your free money earns more free money. This positive feedback loop has a dramatic effect on assets over the longer term. This is a major reason why it’s so important to start investing early to give your money the greatest potential for compound growth.

Lastly, investing is not only important because of the impact of inflation, asset returns and compound growth. It is also important because it can improve your ability to protect yourself and your family against financial knocks. This is often termed financial resilience and is defined as the ability to withstand life events that impact one’s income and investments. Think about what would happen to your household’s financial stability if there was a job loss, debilitating illness, injury or a major home or car expense. Would you be up to the challenge? By building an emergency or rainy day investment fund you can ensure that you won’t have to borrow money to deal with these financial knocks.

When we look at South Africa at large, according to the Savings and Investment Monitor survey published annually by Old Mutual, it’s interesting that the amount of money put aside is actually pretty constant across the board, at 15% to 17% of income regardless of household earnings.

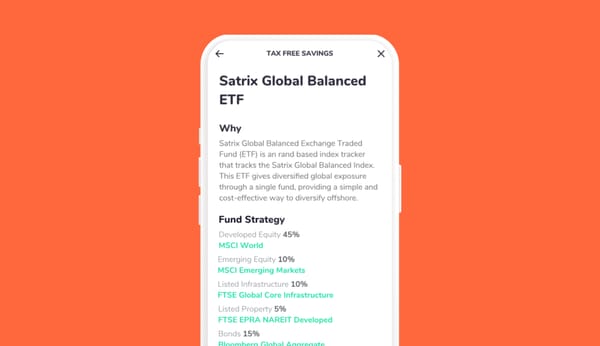

The sad reality is that most people don’t invest this money they save. Only 6% of South Africans invest in either in unit trusts or shares, which means that most South Africans are losing the value of their money over time and not taking advantage of investment returns and compound growth.

"Be smart, don’t be a slave to money. Every day you make decisions about what to do with your money – make the smart choice and start investing today."