You've seen Swizz Beats and Alicia Keys's "The Dean Collection" art collection. You stanned artist Nelson Makamo when he was featured on the Time magazine cover in February 2020, and the fact that Oprah has his art in her home foyer. So, you're thinking, "I want to get into investing in art!" Here's the low down:

Different ways to invest in art

There are direct and indirect ways of investing in art, much like other asset classes like property and shares.

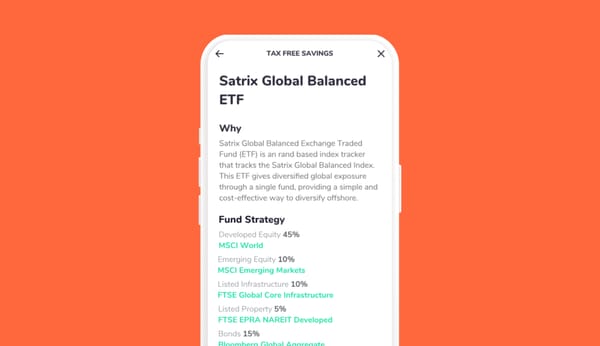

An indirect way of investing in art is through an art fund. In an art fund, a portfolio manager invests in art and you, as the investor, invest in the fund. In turn, you get to share in the fund's performance, much like how unit trusts work.

Direct ways of investing in art include buying physical art like paintings and sculptures or investing in digital art or Non-Fungible Tokens (NFTs).

Investing in a single artwork means you're taking on risks related to characteristics of the artwork, like that artist, the specific features of the art piece and the medium in general. Also, digital art has additional risks related to which blockchain the NFT is on.

Investing in an artwork differs from investing in an art fund, where you outsource risk management to a professional portfolio manager. The portfolio manager picks art pieces and chooses the art portfolio to maximise the return on the portfolio.

Considerations when investing in art

When considering investing in art, I think it is safe to advise that you should buy artworks that you like. In fact, most art collectors have that strategy as a default. As an art investor, it is worth using this as a basis for two reasons.

The first reason is that the holding period for art should generally be long-term, like many other alternative and illiquid investments, so you should enjoy the artwork.

The second reason is that if you are stuck with the artwork for a more extended period, it will still give you some, albeit intangible value.

Like any asset class, it is worthwhile to research the assets before you buy. For investors who are buying artwork directly, there are also professional art advisers who can advise you on purchasing art.

It is also crucial to diversify your investment within the asset class. You should consider diversifying across the source of the artworks, so don't buy only from one auction house or gallery; try to buy from various sources. Also, diversify across artists - maybe investing in emerging artists and more seasoned artists whose works have been exhibited widely. Another metric to diversify across is medium, so consider investing in photography, sculptures or other mediums as well as paintings.

Art, being an alternative asset class, should be a diversifying investment relative to other asset classes in your investment portfolio like property, shares and cash. A 2020 Knight Frank report indicated that collectables, of which art is one form, made up 5% of the net worth of ultra-high net worth individuals. These are individuals with over $30m in assets. So if the value of your assets less your liabilities is, say, R200,000, then you could buy art to the value of R10,000, and you'd be investing like a boss.

So that’s about half the skinny on investing in art. Next week, I’ll cover maintaining and growing the value of your art and then how to realise value through the sale of an artwork.