As a woman who grew up in a female-led household, and who has had the privilege to be mentored throughout my career by dynamic women at the top of their industry, there’s never been a doubt in my mind that women can do anything (and do it well) that they put their mind to.

But even then, when I got the chance to ‘sit down’ (virtually speaking) with a selection of the top female Franc investors this Women’s Month to hear their investing and life stories, I was blown away: many of these women faced impossible odds, fell down, picked themselves up, and started again. And the one thing that tied all their journeys together was a sense of resilience and a steely resolve to learn from their stumbles.

Wrapping up these interviews, the next step was obvious: I needed to capture their learnings to share with other women aiming towards financial freedom for themselves and their families. So here’s just that: hours of interviews and storytelling, condensed into the 7 habits these women have learnt to adopt to be successful investors working at improving and building their lives.

The 7 habits of highly successful (Franc) female investors:

- Set clear financial goals

- Upskill yourself by embracing continuous learning

- Pay yourself first

- Keep an emergency fund topped up

- If you don’t have the cash, don’t buy the item

- Surround yourself with a trusted ‘board of advisors’

- Keep your savings and investments separate

1. Set clear financial goals

One common thread among the women I interviewed was how important it was to set clear, actionable financial goals. In fact, as soon as there was a clear goal, the investing strategy and approach fell into place too, as did the motivation to put the needed money away.

Whether it’s saving for a home purchase, building an emergency fund the investors could always fall back on, or making sure there’s enough of a fund to cover a comfortable retirement, these specific goals gave the investors purpose and direction.

How they do it: Lebohang, mother of four, finds that goals help her stick to the plan: “Setting long-term goals helps me to be patient with my investments. It’s something that constantly reminds you of why you are saving.”

What’s more, she finds it makes investing so much more fun. “What excites me about investing is the prospect of reaching my goals and seeing my life change bit by bit, because of the efforts that I've made.”

How you can implement it: Start by thinking about what you want out of life and your future. Then condense those down into well-defined financial goals. Are you saving for a specific purchase, like a car or a house? Or are you looking to build a nest egg for the future where you can have the freedom not to work if you don’t want to?

Write down these goals and assign a timeline and target amount to each (or better yet, set them up as a Personal or Shared Goal on the Franc app). This will not only keep you motivated, but will also guide your investment choices. Want more? Read our guide to planning, setting and sticking to your financial goals.

2. Upskill yourself by embracing continuous learning

Almost every one of the top female Franc investors I interviewed hadn’t grown up in a family that invested. Everything they learnt about investing, they took upon themselves to learn.

Sometimes that meant sitting down to Google the basics, other times it meant following prominent content creators in the space to fill their social feeds, and for some, it also meant partnering up with like-minded women to learn together, and discuss the options.

How they do it: Kefilwe, a business analyst and busy career woman, found that YouTube videos were her favourite way to learn about investing. “YouTube videos are something I can watch while I’m eating – it's easier for women like me who always love to multitask.”

She actively searches for and follows other South African women who create content about their investing journeys and what they learn along the way because it inspires her to do the same. “I always watch YouTube videos from women. Because if another woman can do it, I can also do it.”

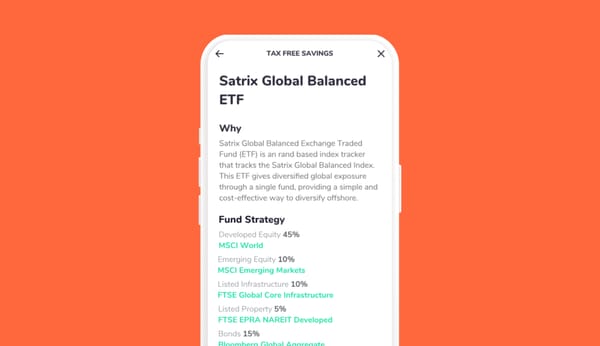

How you can implement it: Find a channel and format that works for you, then make it a habit to check in to consume financial content regularly. Whether it’s through YouTube, blogs, or podcasts, staying informed will empower you with knowledge and help you make smarter investment choices.

Here is a quick cheat sheet of resources you can use:

- Start going through our Franc Academy lessons to get a good foundation of money and investing (get the video versions over here).

- Subscribe to our fortnightly Francly Speaking newsletter for the latest blog posts, videos and resources to help you brush up on your knowledge as you invest.

- We’ve vetted the financial content creators on the social platforms and chosen our top 9 financial content creators to follow to get your daily dose of financial tips, experiences and opinions.

3. Pay yourself first

The concept of "paying yourself first" is a cornerstone for many of these investors. When I dug into the topic with the female investors who used this as their motto for investing, it became clear that it helped them reframe the concept of not spending and rather putting money away from that of ‘sacrifice’ to one of ‘empowerment’.

How they do it: For Chantel, an accountant and mom, the concept of ‘paying herself first’ feels like she’s paying her future self a salary: “It's me paying myself for the commitment that I’ve taken to fix my life and finances.”

And the thought of being able to access that money – guilt free – later in her life, is worth whatever ‘sacrifice’ she feels she’s making now. “My investments are a safe space for me to afford something I want, something I typically would not get in my daily life.”

How you can implement it: First, it starts by reframing what saving and investing is to you. Try strike out the idea of ‘sacrificing’ things you want now, and think of it as a pre-payment for what you want later. You and your family are ultimately going to benefit from the money you put away to grow further down the line.

Once you’ve tackled the emotional component, look at the practical: automate your savings. Set up a debit order from your bank account to go straight into your investment on payday. You’ll avoid having to make the decision between saving and spending on payday, and always prioritise your financial future without having to think about it.

4. Keep an emergency fund topped up

Many of the women interviewed stressed the importance of having an emergency fund to fall back on.

How they do it: Lebohang found out the hard way how important an emergency fund is.

Her “aha moment” came during a moment of crisis: “In college, I was dependent on a stipend. When they took our pay away for a month, it really scared me, because going back to having nothing was just going to be traumatic for me, especially since you've had a taste of living off something.”

Having an emergency fund now provides her with the comfort of having some protection and choice in a desperate situation.

How you can implement it: If you don’t already have an emergency fund, start building one today. Aim to save at least 3-6 months’ worth of living expenses in an easily accessible account with low-risk growth, like the Franc cash fund, separate from your investments.

5. If you don’t have the cash, don’t buy the item

I can’t tell you how many times I heard these top female investors say this, at separate times, in separate ways. If they didn’t have the right amount saved up for that specific purpose, they wouldn’t buy it. Unless it was ‘good debt’, like a house purchase, they just didn’t want to owe anyone money.

How they do it: Many of the investors I interviewed learnt the hard way what spending what you don’t have can do to their finances, including Chantel: “When I started working, I already had financial commitments. On top of that, starting life in corporate meant a lifestyle inflation, too. So I made all the financial mistakes you can ever think of.

But when COVID happened, and our pay was cut, I realised that I was financially overstretched in all possible ways. I couldn’t afford the pay cut. And that's where the deal breaker was for me to start saving and investing for things that I want. And now, if it's not money I’ve saved for that, I will not go and tap into my Franc account for an expense that was unplanned.”

How you can implement it: It might be easier said than done, but embrace delayed gratification. If there’s something that you want that’s not urgent, relish the time spent setting up an investment or saving goal for it, putting money away every week or month to save for that item, and buying it, without guilt of your financial situation.

6. Surround yourself with a trusted ‘board of advisors’

And by advisors, we don’t mean financial advisors necessarily (although those can be helpful too, in the right situation), but rather a diverse community or group of people to get different perspectives on money and investing.

Many of the women I spoke to emphasised the importance of community – surrounding themselves with like-minded individuals who are also focused on financial growth. This support network offers inspiration, advice, and motivation to stay committed to their goals.

How they do it: Dudu, a woman who has built up many income streams to fund her family’s lifestyle and the purpose-driven work she does after hours, found a women-only investing group gave her a headstart on her investing journey: “I was drawn to this community of young black women saving and investing. They were fun and inspiring, and doing amazing things as CFOs and investment managers. Even though I didn’t bring the financial expertise to the table, because I’m older than them and I’ve been around the block, I have experience to contribute to the conversation.”

Karabo, an entrepreneur and art investor, lives by this advice, too: “Don't be afraid to ask people for help or advice. But ask widely. Talk to as many people as possible to get a wide range of insights, because people experience things differently.”

How you can implement it: Find or build your own community of support. Whether it’s joining an investment group, getting involved in online forums, or simply talking to friends who share similar financial goals, having a support network can provide valuable insights and keep you motivated.

7. Keep your savings and investments separate

Having discipline and patience not to dip into your savings and investments when you want something isn’t easy – if it was, everyone would be a Warren Buffet of investing. But putting certain ‘safeguards’ in place to avoid this temptation is what sets these top female Franc investors apart from the others.

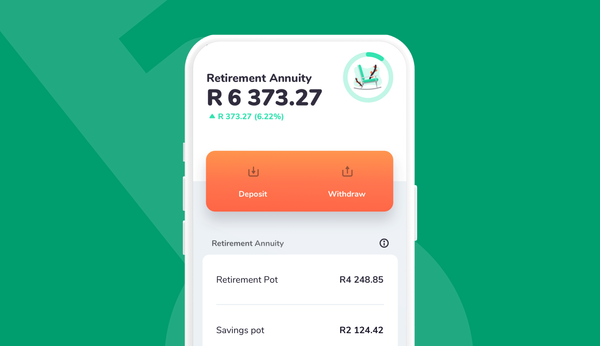

How they do it: Lebohang learnt the hard way that savings accounts on your banking app are a great recipe for temptation: “Before I opened up the Franc app, I would put my savings into a savings account on my banking app. But I realised that it's too easy to access. I would always withdraw for unnecessary things.

Having my savings and investments separate, in my Franc account, helped me become more disciplined.”

Even though you can withdraw from the Franc app at any time, the extra process and checks and balances in place to access her money helped her think twice. “The Franc app gives you discipline, because it's a process to withdraw your funds. You have to log on to the Franc app, transfer your funds to your bank account, etc. It makes you think before you actually withdraw.”

How you can implement it: Find an investing platform that works for you, that’s separate from your day-to-day accounts, and set a debit order to deposit into it regularly. It will help you resist the urge to make impulsive decisions based on short-term wants.

The bottom line

These seven habits are not just about investing – they’re about taking control of your financial future. By setting clear goals, continuously learning, paying yourself first, building an emergency fund, building out your money-savvy community, investing with purpose, and staying disciplined, you can start on the path to financial freedom.

The journey might be challenging, but as these successful women have shown, it’s absolutely worth it.

So, what habit will you start working on today?