Stokvels are an important part of the South African savings culture.

Historically, stokvels were one of the few ways that people were able to help each other to save and improve everyone's financial well-being.

Many stokvels still operate in the traditional way – a group of people meet every month, they each put an agreed amount of money on the table, and one person, on a rotational basis, takes that lump sum and uses it to make an important purchase.

It's a way of helping one another buy the things that improve our lives in a world where it's all too easy to spend everything we earn each month on basics and essentials.

Of course, there are many variations on this idea – each stokvel can make its own rules. Some stokvels give half of the monthly pool to one member and add the rest to an emergency fund which is available to members in case of emergency – or some special need, like a funeral. Other stokvels build up a fund and pay out a portion to each member in December or only when it's really needed.

At the root of the stokvel concept is a discipline of saving, of putting some money aside that otherwise gets frittered away.

To this day, many small stokvels hold the emergency fund portion in cash. One member is entrusted to look after the old Bakers Biscuits tin and keep it well hidden.

This principle of trust is central to stokvels. The members have to trust one another to all make the monthly payments, and one or two elected people have to be trusted to act as custodians of the fund.

Biscuit Tin Alternatives

There are two main disadvantages to keeping cash in a tin:

1. The money can be stolen or lost in some other way (a fire, for example).

2. The cash in the tin gradually loses value over time because of inflation.

Inflation is more insidious than many people realise. If prices go up 6% a year, in 10 years your money loses nearly half its buying power – R100 is worth only R56 after a decade of 6% inflation.

Understanding that money can grow if it's invested, many stokvels open savings accounts at banks and deposit each month's cash. Some banks offer "club" accounts for this purpose, other banks actually call them Stokvel Accounts.

There are a few serious disadvantages to traditional stokvel/club savings accounts.

1. Some of these accounts only allow cash withdrawals (almost inconceivable in this day and age, but it’s true).

2. Some require two signatories, meaning that two people have to physically go to the bank to make a withdrawal.

3. Most importantly, all these accounts pay very low interest.

I did a quick survey while writing this article and I couldn't find a single bank paying interest on stokvel/club accounts that came close to the inflation rate. Most were paying just over 1%. That means that the stokvel's money continues to lose value even though it's invested.

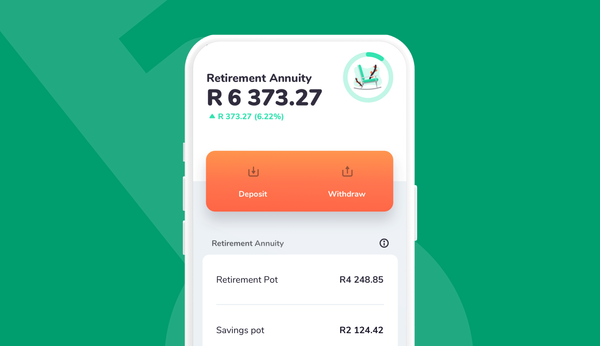

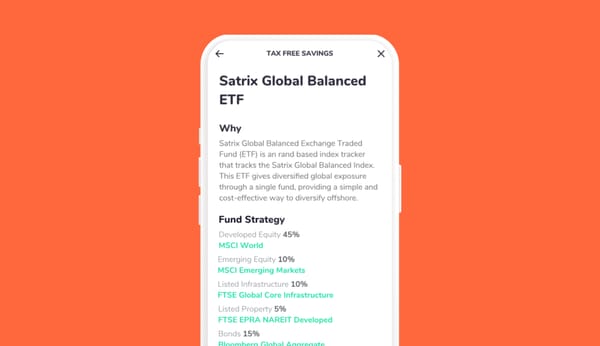

But there are other options. Apps like Franc create platforms for the same kind of savings discipline that make stokvels work. They also pay better interest and make deposits and withdrawals much easier.

App Advantages

Before we flesh out the advantages, bear in mind that a platform like Franc means each stokvel member needs a smartphone and a bank account. These aren’t usually obstacles – in today’s world it's hard to live without some sort of bank account, and there are now fantastic phone-based banking products that are very cheap.

Of course, one or two people have to be trusted to administer the account, but this is the same for all stokvels no matter how they are run.

Another disadvantage of using a platform is that members may not get to socialise with each other in person as often, but in this day and age of Covid-19, this might be a blessing.

The advantages of a platform like Franc are convenience and better growth:

1. Each member deposits into one account using their phone – no more visits to the bank required.

2. The transaction history is available for all to see.

3. If a member needs to access the emergency fund, a transfer can be done almost immediately.

4. And, most importantly, the stokvel's money earns a better rate of interest.

At the moment, for example, the interest rate on the Allan Gray Money Market Fund – which is the risk-free vehicle we use at Franc – is more than three times the average rate being paid on stokvel and club accounts by the major banks.

Using a platform like Franc allows you to benefit from the community nature of a stokvel without the disadvantages of holding cash or making monthly trips to the bank.

It's not a different thing, just a better way of dealing with the money.

Stokvel members can and should still monitor each other to make sure everyone is sticking to the agreed plan in order to achieve the group's goals.

Supercharge your stokvel – stop using the biscuit tin, and switch from outdated banking products.