Since its launch in 2009, Bitcoin and other cryptocurrencies have established themselves as a recognised asset class. At the same time, most people know that these are highly speculative and volatile.

So the question is: should you invest in Bitcoin?

What to consider before investing in Bitcoin

Bitcoin has had many ups and downs since its inception

Longer-term investors in Bitcoin have had a wild ride.

If you were lucky enough to buy some Bitcoin before 2013 (and you resisted the urge to take profits) you are looking at gains of 150,000%. To put that into perspective, $1,000 invested in 2012 would be worth at least $1.6m as at July 2024.

But in between was a terrifying roller coaster, with several declines of 75% to 80% (the most recent being in 2023).

For example, the first few years it existed, Bitcoin traded at under $10. From mid-2012 the price started rising, soaring to nearly $300 in April 2013. By July it was back below $70, but four months later it went over $1,000, and by January 2015 it was below $200. It was not until 2017 that Bitcoin got back to $1,000 and held that level.

The price swings have not been as dramatic in recent years, but Bitcoin’s price volatility over the last five years (to July 2024) remains at least four times that of the stock market. Such falls make it hard to hold your nerve.

Bitcoin, in short, is the opposite of a steady, conservative investment – but it’s not all bad. Let’s look at the pros and cons:

The cons of investing in Bitcoin

Let’s talk first about the reasons to be wary. The first is the price risk we illustrated above.

In the financial markets, risk can be defined as uncertainty of outcome.

Given that Bitcoin has historically been much more volatile than shares, any investor needs to be aware of the riskiness of crypto.

Uncertainty of returns is by far the biggest reason not to buy Bitcoin, but it is not the only consideration. Other potential pitfalls include the way crypto is traded and held, and the risk of fraud.

There are many documented cases of Bitcoin owners losing their passwords and having to walk away from crypto assets worth millions of dollars. There have also been stunning crypto exchange failures, including the FTX scandal in 2022, where customers lost around $8 billion. And phishing attacks are just as prevalent in the crypto world as they are in the conventional banking system.

All of these have built a lot of mistrust around the investment in cryptocurrency.

The pros of investing in Bitcoin

In the face of these risks, what are the positives?

As risky and volatile as Bitcoin is, volatility is also the reason Bitcoin can deliver huge gains.

This creates risk, but also opportunity. Being on the right side of price action creates profits. In early 2019, Bitcoin traded at under $5,000; in early 2021 it went over $63,000 – a twelve-fold increase in two years. A selloff followed new highs in November 2021 and by late 2022 bitcoin was under $20,000 – only to climb back to $73,000 in March 2024.

Two obvious conclusions follow from this picture: one, that it’s dangerous to buy Bitcoin at historic highs, and two, that buying Bitcoin at historic lows can lead to big gains.

Here’s a quick summary of the pros and cons:

Should You Buy Bitcoin?

Considering the pros and cons outlined above, it’s clear that Bitcoin is a high-risk asset class. But with big risks come potentially big rewards.

On balance, we feel that the potential gains from Bitcoin are worth the risk – and that some exposure to crypto is therefore a good idea in a diversified portfolio.

How to mitigate the Bitcoin investment risk

There are two ways to better protect yourself from the risks of investing in Bitcoin:

- Bitcoin should be avoided by investors who are risk-averse. If you don’t have an emergency fund saved and any other investments as part of a diversified investment portfolio, or you simply can’t handle risk, you should avoid investing in Bitcoin.

- Bitcoin should make up only a small percentage of your overall invested amount. Many investors like to keep their invested amount in Bitcoin lower than 2% of their overall capital.

How do you invest in cryptocurrency?

For those with the risk appetite, the question perhaps is not should you buy Bitcoin but how to buy Bitcoin – a question that encompasses both platforms and the investment approach.

Platforms to invest in Bitcoin

To acquire Bitcoin directly requires an understanding of wallets (hard or soft, hot or cold), trading fees, encryption keys and other technicalities.

If you have a substantial portfolio, this knowledge is worth acquiring, but for most ordinary investors other channels may be a better option:

- The crypto ETFs now available in the USA are one possibility, although this requires using your annual investment allowance (the purchase would have to be in US dollars as there are no crypto ETFs in SA as of July 2024).

- Some broking firms, like EasyEquities, offer access to crypto bundles.

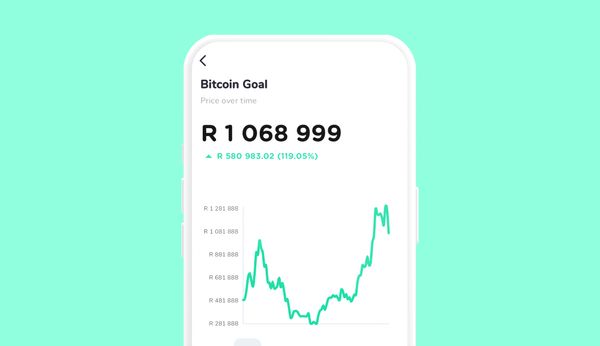

- The Franc app offers an extremely simple and straightforward way to invest in Bitcoin.

Approach to investing in Bitcoin

Whatever platform you use, consider rand-cost averaging as an investment approach: an investment strategy where you invest smaller, fixed amounts at regular intervals (usually monthly) regardless of what the market might be doing at the time.

This approach works well because when it comes to such a volatile asset, timing the market is tricky. For example, it might have seemed like an opportune buying opportunity in January 2022 when Bitcoin fell from its November 2021 high of $67,500 to under $40,000, but after an up-and-down rally the price fell to under $20,000. Watching an investment halve in value is not fun and can trigger impulse selling, locking in losses.

If you’re investing regularly such as in the case of rand-cost averaging, if the value of Bitcoin rises, you’re in the money; if it falls, you get a little more for each deposit and your average cost reduces progressively, putting you in a good position to profit when the price recovers.

The bottom line

To wrap it up, investing in Bitcoin is a bit of a wild ride, packed with both big ups and big downs. While its history shows that it can deliver massive returns, those returns come with a hefty dose of risk. If you’re comfortable with high stakes and have a well-diversified portfolio, Bitcoin might be worth a small slice of your investments.