If you’ve landed on this blog post, that means you’ve already taken the first mental step to becoming a seasoned investor. You’ve realised that you want to grow wealth for the future, and you’re actively looking to upskill and educate yourself. Congratulations!

Investing can seem daunting, especially if you're new to it. But with a bit of research, the right tools, and a test-and-learn approach, it can be a powerful method to grow your money and achieve financial independence.

Here are the five simple steps to start your investment journey with Franc:

- Figure out how much you can invest

- Understand your risk tolerance

- Define your investment goals

- Choose your investment strategy

- Make your first investment

Step 1: Figure out how much you can invest

Figuring out how much you can and should invest depends on your financial situation, goals, and risk tolerance. Before you start investing your money, we always recommend having a budget in place and an emergency fund (3-6 times your monthly income saved in a fund that has some growth but is easily accessible) to cover any unforeseen expenses before you start putting funds into an investment.

Even if you don’t have much to invest right now, the important thing is to start small with what you have, as soon as possible. You can then gradually increase your investments as your financial situation improves. The longer your money is invested, the more chance it has to grow – that’s the power of compound growth.

Step 2: Understand your risk tolerance

There’s no two ways about it: investing comes with risk. But different funds have different levels of risk. Your risk tolerance is the amount of risk you're willing to take with your investments – the more risk-averse you are, or the more fragile your financial situation, the less risk you should take on.

It's important to understand investment risk and get to know your risk tolerance so that you can make informed investment decisions before you even get started.

Step 3: Define your investment goals

Now that you know how much you have to invest and how much risk you should take on, it's time to define your investment goals.

Are you saving for retirement, a down payment on a house, or building an emergency fund? Your goals will shape your investment strategy and help you make informed decisions. Plus, further down the line when you’re wondering whether to put that money into your investment or a holiday, you’ll have your goal in mind to guide you.

Step 4: Find the right types of investments

Once you've identified your goals, you need to choose the right types of investments to help you meet them, and suit your risk tolerance.

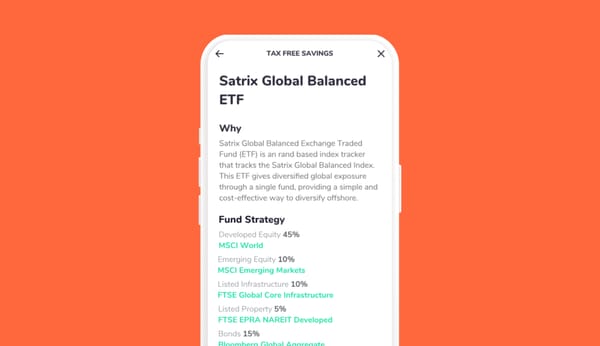

There’s quite a variety of options to choose from, from stocks and bonds to exchange-traded funds (ETFs), and more. Do your research so you understand what you're working with – our Academy or our guide to the Best Types of Investments in South Africa are both good starts.

The golden rule is to diversify. When it comes to building your ‘portfolio’ (your mix of investments), make sure you diversify – or spread your risk – by investing in different asset classes. Read more about the importance of diversification, and how to actually go about it.

Step 5: Make your first investment

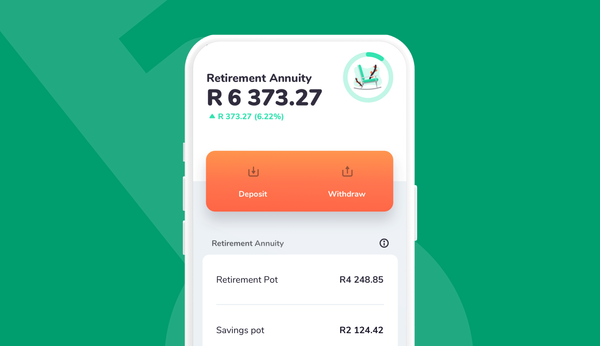

You’ve made it this far – now it's time to take the plunge and make your first deposit into your investment. Some investment companies require you to manually fill out a form and submit it to start investing in an investment account. With others, like Franc, you can sign up online and start investing immediately.

Before you open an investment account, make sure you do your research: understand what the fees are, what the minimum investment amounts are and if your investments are locked up, and how easily you can access your money if you need to.

If you’re not sure about anything, ask questions: you’re investing your hard-earned money and you deserve to understand where it’s going.

Have more questions? Here are some answers to the questions we get all the time from Franc investors:

Q: How much money do I need to start investing?

A: You can start investing with as little as you have on the Franc app – there are no minimum amounts and you’re not locked into a specific amount. The key is to start small and gradually increase your investments as your financial situation improves.

Q: What are the risks of investing?

A: Investing does involve some risk due to market volatility (the value of investments going up and down) and potential losses. Diversifying your portfolio and investing in a mix of fund types over the long term can help protect your money against these risks.

Q: How do I choose the right investments?

A: When you’re choosing which investment is right for you, consider your goals, risk tolerance, and how long you want to invest for. Diversify your portfolio by investing in different asset classes, and seek professional advice – either from a financial advisor or robo-advisor – if you feel you need more help.

Q: How often should I review my investments?

A: It's recommended to check your investments at least once a year, or whenever there are big changes in your financial situation or investment goals.