The only things certain in life are death and taxes. These famous words are attributed to Benjamin Franklin, who said other noteworthy things, like "lost time is never found again" – something worth remembering when we are tempted to postpone our investment strategies.

But back to the subject of taxes. What taxes apply to investments? How do they impact rates-of-return? And can you reduce the impact of tax on your investments?

At Franc we favour low-cost investments for the obvious reason that fees are a direct charge on performance. In the same way, taxes are a deduction against your investment – they reduce your rate-of-return.

Believe it or not, you can structure your investments to minimise tax – but first you have to understand what it is you're trying to minimise.

What taxes apply to investments?

There are three main taxes that affect us as investors:

1. Income tax

2. Dividends withholding tax (DWT)

3. Capital gains tax (CGT)

The first two – income tax and DWT – are both really a tax on investment income, but they are dealt with differently by the taxman so we'll talk about them separately.

Tax on Dividends

Dividends are a form of investment income you get if you own shares in companies – it is a portion of annual profits paid out to shareholders. Most – but not all – listed companies pay dividends. If you invest in a unit trust or ETF (like the Satrix Top 40), the fund passes on the dividends it receives to you.

Dividends are subject to something called Dividends Withholding Tax (DWT), which means tax is deducted at source and you get the net amount. Unless you're a non-resident or hold your investment through a company there's not much you can do about DWT – 20% of your dividends are syphoned off by the state.

Tax on Other Investment Income

DWT aside, the income you earn from other investments – like interest and rent – is taxed as part of your general income. If you rent out a room or cottage, for example, the net income after expenses is subject to tax. In the same way, interest you earn from investments is subject to income tax.

Some countries have a withholding tax on interest, but in South Africa interest earned must be added to other income before income tax is calculated. This might not make sense to you if you've only ever dealt with PAYE (Pay-As-You-Earn), but PAYE is actually just a system imposed on employers to make life easier for the taxman – in reality, income tax is based on an annual earnings.

You're not taxed on the first R23,800 you earn in interest, but if you receive more than that the rest is taxed according to the bracket you're in (eg, 31% if you earn between R353,101 and R488,700 per year). So if your salary is R360,000 per year and you have investments that produce interest of R50,000, you pay R8,122 in tax (31% of R26,200, which is R50,000 less R23,800). The final calculation is done by the taxman after you have submitted your tax return.

Capital Gains Tax

Some investments, like a fixed deposit, only earn interest; others, like properties and shares, may produce both income (ie. rent or dividends) and capital gains. If you can sell an asset for a profit, that's a capital gain. The profit is taxed.

CGT works in a similar way to the tax on interest described above but the formula is slightly more complicated.

You are not taxed on the first R40,000 of capital gains each year. So if you hold an ETF like Satrix Top 40 and you make a profit of R20,000 when you sell, you will not have to pay CGT. But above the R40,000 threshold, 40% of the capital gain is added to your income.

By way of example, if you sell a buy-to-let flat (not your home, that's different) for a profit of R150,000, you will add R44,000 (40% of R150,000-R40,000) to your taxable income. In the 31% tax bracket, you will pay R13,640.

This seemingly complicated system is designed to link CGT to tax brackets. The same profit of R150,000 could attract tax of as much as R27,000 in the hands of someone earning over R1.7m a year (assuming other capital gains).

Minimising Tax

Headlines about people going to jail for tax evasion might make you think you're not allowed to take steps to minimise tax, but this is not true – there are many entirely legal ways to reduce tax.

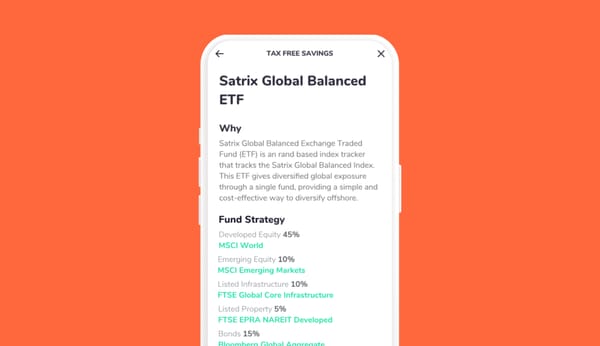

Some of them, such as TFSAs and TFIAs are actually created by the government to encourage people to save and invest.

Tax-free accounts are the easiest way to minimise tax on investments, especially if you're starting out – take advantage of them.

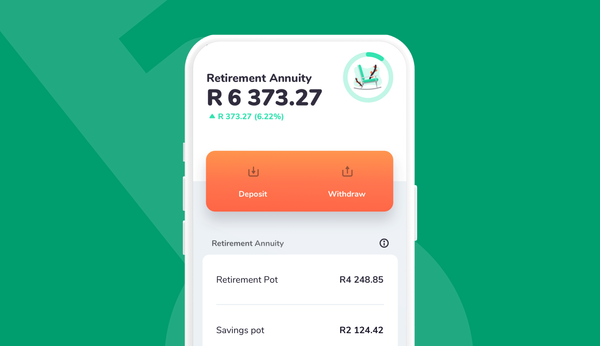

Other ways of delaying or reducing tax include products like RAs (retirement annuities) and endowment funds – or even just ensuring you keep proper records and claim all the allowable expenses against rent received.