There are largely two schools of thought about investing: should you buy-and-hold or buy-low-sell-high. Although the latter intuitively makes the most sense and when you look at investment charts we can't help but play 'what if'. What if we'd bought bitcoin (BTC) ten years ago in 2012 for just $5 and sold it at the start of the year for $50,000 you would have made 10,000x your investment!

Unfortunately it's never as easy as that. The problem is knowing when to buy and when to sell. Warren Buffett is quoted as saying that "in the short term the market is largely a popularity contest, whereas in the long-run it's a weighing machine". What that means is that in the short term (say less than 3 years) the stock market prices are inherently volatile (a financial term that means the price changes a lot) as public popularity or sentiment flip-flops, in just the same way that fads come and go. But what Buffett means when he says in the long-run the market is a weighing machine is that physical weight (underlying value) of the stock will unlikely change and become easier to measure.

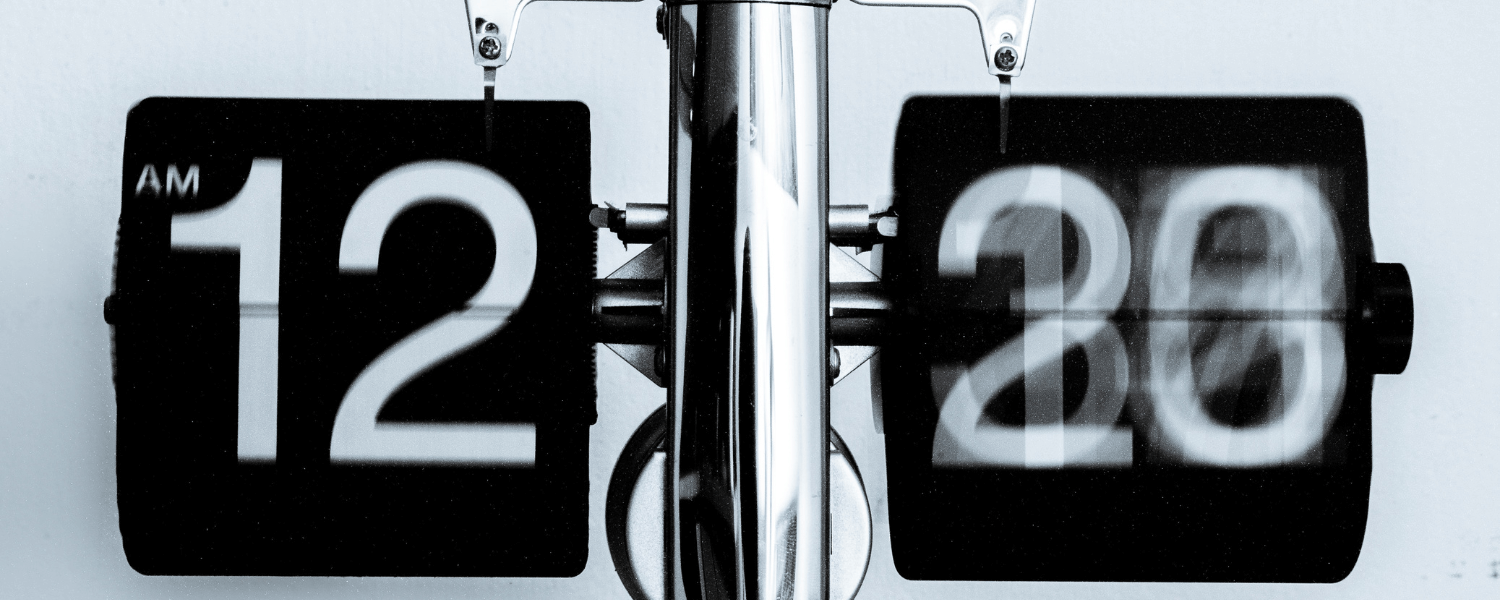

Some investors see market volatility as an opportunity to buy low and sell high. And, of course, everyone has 20/20 vision looking backwards and imagine fabulous profits that can be made if only you bought in troughs and sold when the market peaked (as per BTC example earlier). The problem is that predicting the future is hard and filled with uncertainty. Knowing when to buy and sell has attracted hoards of pundits touting insight from conference podiums and filling libraries of textbooks, but always with the same variable outcome.

The alternative to the buy-low-sell-high strategy is a buy-and-hold strategy, proposed by Buffett himself. Traders are very quick to mock long-term investors when the market declines. However, value investors argue that good companies will always recover and that equities reliably beat other asset classes when it comes to long-term rates of return. Frequent trading is often also a lot more expensive than the buy-and-hold strategy because of the underlying transaction cost involved.

Our Chief Investment officer, Nic Oldert, published an article for ProfileData, that wanted to answer the question: what are the prospects for the buy-and-hold investor if the entry and exit points were random (the equivalent of throwing darts blindfolded at a calendar)? This may seem absurd, surely selecting when to buy or sell is better than throwing a dart blindfolded? However, if you think about it, investing is often a function of cash flow (eg. when you inherit money or because you need an injection of cash for a medical emergency) which has its own randomness; but I digress.

Nic calculated 12 month returns over holding periods from one year to ten years going to back to March 1996. Obviously, this 1996-2019 period may not be representative of all time, but it does include the major correction of 1998, and the crash of 2008, and two long periods of low market returns -- hardly the best period to choose.

The results showed that you had a 95% chance of a positive return across all 2150 periods. Interestingly, all negative returns were for periods of three years or less. The analysis supports the rule of thumb that equity investments should be held for at least three years. So as long as you held for more than three years, you at least preserved your capital.

In terms of the returns, for periods of more than five years, the worst case scenario was 5% annualised growth. Sceptics might say why bother investing in equities if risk-free investments offer the same return or better. The answer is that with equities there is upside whereas in a savings account 5% is the best you were going to get. By comparison, in equities over all periods, there was almost 75% chance of a 10% return p.a. or better, a 47% chance of a 15% return p.a. or better and a 22% chance of getting a return of 20% p.a. or better.

This analysis suggests buy-and-hold investors got it right, especially if you can delay your exit point until the market is bullish. To minimise the impact of volatility, it's best to stagger your investment over time, buying index-tracking ETFs in regular instalments and holding for as long as possible. Similarly, to de-risk their investment portfolio, seasoned investors typically sell and transfer their equity investments into cash investments in tranches over many years to ensure they have sufficient emergency capital which requirement obviously increases as you age.

And so it seems patience and prudence leads to the best financial reward.