The best way to understand what passive investment means is to understand what it is not. Passive investment is the opposite of active investment. Active investment typically refers to any fund that is actively managed. This means you're effectively paying someone to make day-to-day decisions about what to invest in.

The problem is active investment fund managers are human and can make mistakes, and often do. Herein is lies the issue. The fees charged for active management are about 2% of your investments - that's R2 for every R100 invested per year. But that fee is paid regardless of how well the fund performs. So when times are you good, you're happy. But when times are bad, you will be very, very disappointed. Because with active management not only do you have to swallow the mistakes made by the fund manager but you're paying him for making his mistakes!

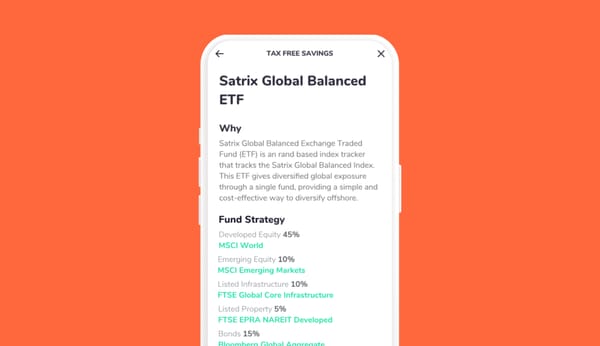

That's why passive investment is so much better. Passive investment implies that the fund is not actively managed. Most often, this means that there is a simple algorithm (or formula) that defines how your money should be invested. In simple terms, you're not paying anyone to manage your money. And so, passive investments are generally a lot cheaper than actively managed funds. Just compare Allan Gray Balanced Fund, which has a total expense ratio (TER) of 1.7%, versus Satrix Top40 index-tracking exchange traded fund (ETF), which has a TER of 0.12%. That's more than 14 times cheaper!

(To understand the impact of investment fees over time, read our blog post "It's all about the fees!")

So what's an index-tracker?

Index funds are investment portfolios that track the performance of basket of publicly listed companies. Think of an index as an average of company values. Most indexes are weighted so that bigger companies make up more of the index than smaller companies.

But let's take a step back. Anyone can buy and sell the shares of listed companies on the stock market - known as the Johannesburg Securities Exchange (JSE). Buying shares in a company makes you part owner in that company. In the long term, you can expect the value of your shares will go up if the company is profitable. In simple terms, the more profitable a company, the more the value of its shares will increase.

Before the advent of index funds, investing was all about trying to identify the most profitable companies (i.e. active investment). The JSE offers about three hundred companies to choose from. Working out which ones are going to be the most profitable businesses over the next five or ten years is a surprisingly difficult task – even the best qualified fund managers get it wrong at least half the time.

In fact analysts recently started noticing that a lot of active fund managers were not able to produce better returns than the indexes. In other words, fund managers would spend a lot of time (and your money) trying to choose the most profitable shares, but after three or five years you would have been better buying indexes that simply tracked the market.

For example, the Satrix Top40 ETF tracks the performance of the top 40 biggest companies on the JSE. Every day on the stock market some shares go up in price and some go down, which will alter the mix of companies in basket and either increase or decrease the index value. Therefore, but investing in Satrix Top40 ETF you're effectively buying the market and at low cost.

Are index tracker funds a better investment?

The data speaks for itself. Of 160 South African equity funds that have been around for 5 years or more, only 1 in 5 are passive funds. But almost half of the top 20 performers over five years are passive funds. So given the comparably small number of passive funds to choose from, you had a much better chance of picking a top 20 performer if you went for a passive fund, 1 in 2 compared with 1 in 12.

But there's more - the average performance of the active funds was 16.4%, whereas the average performance of the passive funds was 21.4%. In other words, the returns generated by passive funds were distinctly "above average" when compared to the active funds.

The other thing about index funds is that they tend to be more consistent than active funds. Over any and every time period, there are always active fund managers who do better than the major indexes. The problem is that it's not always the same fund managers. Over the long term, there are very few active funds that consistently outperform the benchmark indexes.

"When it comes to long-term investing, consistency is key."

The Bottom Line

The growing popularity of passive funds can be attributed to several factors. An index can provide exposure to the largest and most important companies. They charge the lowest fees. And they consistently provide above-average investment growth.

Of course, the world being what it is, passive funds themselves are becoming increasingly complicated, and there are now hundreds of different index funds. In our view, this defeats the core purpose. A highly specialised index simply moves the problem of share selection from a fund manager to an index engineer and the algorithm he designs. In the long term, we believe the best passive investments will remain the broad-based funds tracking mainstream indices.