How you go about investing and how much risk you are willing to take on are two things that will be informed by what type of investor you are. That’s why it’s something we will often ask when we do a quick survey call; we always want to learn more about our investors and what their view of themselves is. It helps us make better informed decisions about the app. There are lots of different ways to describe what type of investor you are.

How much risk are you willing to take?

Conservative Investors

Conservative investors are not comfortable taking risks with their money. They want a large amount of certainty that any money they put into an investment will not be lost. Safety of capital is prioritised. However, by taking less risk they sacrifice potential returns. Sleeping easy at night can have a significant cost!

One reason someone could fall into this category could be that they are about to retire soon or are already well into retirement and can no longer afford to take risks as they will not have the time to recover from any losses. Younger investors with a conservative mindset should consider doing some research to see for themselves how much not being invested in the markets is actually costing them. Being invested in the markets has risk in the short term but there is almost a greater risk of not being invested.

Aggressive Investors

Aggressive investors don’t mind taking calculated risks with their investments. They are the ones who might do things like putting money into cryptocurrency or day-trade stocks, much like the Redditors who caused a bit of chaos by trading GameStop earlier this year. These investors are willing to risk their capital for the chance that they may get some big wins and often they ignore diversification. If you make very aggressive investments in highly speculative assets you should be prepared to lose money. High potential reward means higher risk. Having an emergency fund will be even more important for you to make sure you don't lose all of your money if an investment doesn’t perform the way you want it to.

That said, some people may be classified as aggressive investors and invest in quality shares but be in it for the long term - this is a strategy that has historically shown to work and includes diversification and most importantly patience.

How involved are you in making investment decisions?

Active Investors

Active investors enjoy buying and selling assets; they are always on the lookout for new opportunities to potentially increase their returns. They will need to spend a fair amount of time researching potential investments and watching the markets to make sure they enter and exit at the right time. This is easier said than done though as nobody knows what the market will do.

The key to being an active investor is setting targets so you know when it is a good investment and when it is time to sell that investment. ie. you decide to sell once the share hits a certain price or PE ratio gets to a certain level that may show it is now overvalued. This will depend on your own analysis and why you thought the share was attractive in the first place. Active investing can be quite costly given repeat trading costs etc.

All this research means that active investing can take up quite a bit of time and energy. In fact, on one call I had with a Franc investor, Dayne Deedat, he explained why he, an active investor, still uses Franc: “Easy, stress-free investment app that I kind of need, because otherwise I am the one stressing out, when I use other investment apps.”

Passive Investors

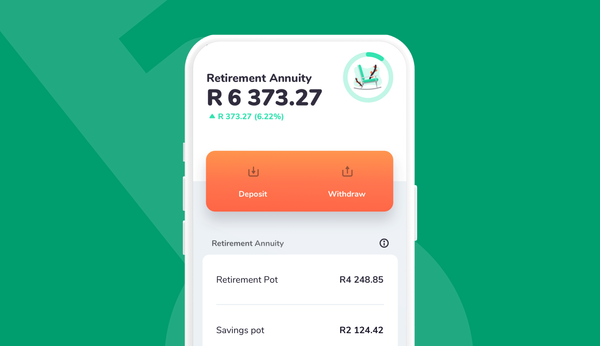

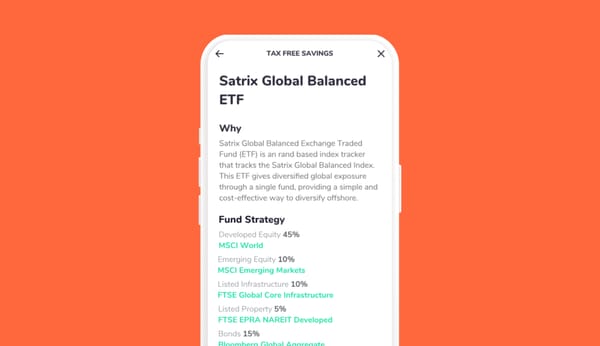

Passive investors differ from active investors because they are not committed to spending a lot of time watching markets and doing research. They are either too busy or would prefer to do other things with their time. They have a long term strategy that informs all of their investing decisions and they stick to it, even when they hear about GameStop and it’s potential to make them a whole lot of money right now. This is the kind of investing we encourage. Especially since research has shown that passive investing often generates better returns than active investing. That’s why once you’ve set your goal with Franc and start investing, you let your money do the work for you.

So what am I?

The categories above are also not mutually exclusive. An aggressive investor is often an active investor. Also depending on your life situation you may transition from one to the other. As we explained above, someone may move their investments from an aggressive portfolio to more conservative one as they get older.

There you go, like with a lot of things in life there is no one way to be an investor. It’s all about making the right decision for you at the time. Now that you know about all the different investor types, which one do you think you are and will you be the same in 5-10 years?

Join in the conversation on Twitter using #FrancFridays and let us know what you’ve learned today?