On 1 September 2024, the long awaited new “two-pot retirement system” will come into effect.

This change in legislation has been brought about to try to balance two objectives which are in tension with each other:

- To allow people to access some of their retirement savings before retirement in the case of an emergency,

- To also ensure that there is a limit on what can be accessed ahead of retirement to give savers the best chance of retiring with enough money.

Why is the retirement system changing?

It is well known that less than 10% of South Africans can retire comfortably, which is a mind-blowing statistic.

The reasons for this are underinvestment – people not putting away enough every month into a retirement product or other investments – but also being allowed to cash in their retirement funds on certain events like resignation.

It has unfortunately been common practice where people would resign just to access their retirement savings (even though they would be heavily taxed). When retirement came along, these same people didn't have enough to live off.

Explaining the new two-pot retirement system

Previously when you made a contribution to your retirement investment, the money was collected into a single pot which you would then utilise at retirement to cash out a portion and/or purchase a retirement income product (life annuity or living annuity).

The only way to access any of the funds ahead of retirement was if you were retrenched or resigned from your job and cashed out your retirement savings (a bad idea, as explained above).

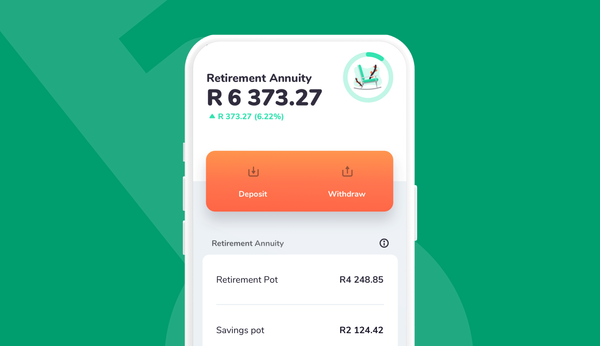

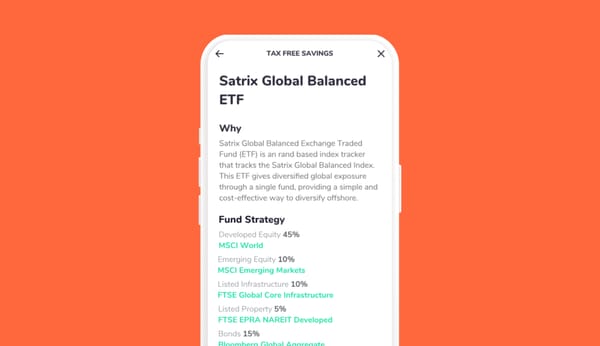

Now when you contribute to your retirement investment, your contribution is divided into two “pots”:

- One-third of your contribution will go into a “savings component”, and

- Two-thirds will go into a “retirement component”.

You will still have one account but each of the above components or “Pots” will have different rules. This can be explained in the table below:

What happens with my existing retirement investment?

The new two-pot retirement system only impacts any future contributions you make on or after 1 September 2024.

Your existing retirement investment will remain the same but for a few tweaks:

- A savings component will be split out. In order to give people access to some of their existing retirement investment after 1 September 2024 and before their savings component has had time to accumulate, a certain amount will be used to “seed” or start the savings component off. This will be 10% of your retirement investment value on 31 August 2024, or R30,000, whichever is lower.

- You’ll be left with a vested component. The remainder of your retirement investment after your savings component is split out is called the vested component. The vested component will be governed by rules before the two-pot retirement system comes into place – for example, you can only access this money on retrenchment or resignation, like before.

It’s worth noting that if you have been a member of a retirement fund since before 1 March 2021, and you were 55 or older on that date, you will automatically be excluded from the new system and your investment will remain unchanged unless you decide to opt in to the new rules.

So are you saying now I don't need an emergency fund?

NO! The savings component of your retirement fund should only be touched if there are no other alternatives. This new legislation should not impact your current investment strategy – assuming it was good to start off with.

You should still build an emergency fund for unforeseen situations, as well as be putting money away to further build your wealth.

Let compounding work its magic

Every amount taken from your retirement investment now means that the total you have in retirement will be much less. That’s because you aren't giving the magic of compounding the chance to do its job.

To show this in an example: let’s say Lethabo is 35 and has R250,000 invested in a retirement fund.

She chooses to withdraw R5,000 every year from her savings component.

When she is 65 years (assuming no further contributions and a 10% annual growth), her investment is worth R3.45m.

Not bad, you may say.

Sure, but if she left her retirement fund untouched over the full period of investing, the amount would be R4.36m.

That’s R900,000 she missed out on when she eventually retires, even though she only withdrew about R150,000 over her saving period.

The bottom line: save a separate emergency fund and leave your retirement fund for when you actually retire.