As a Franc customer, you have 2 funds to choose from. Our cash fund is best for short term goals (risk free with an inflation beating return) and we suggest equity exposure (shares in companies) for longer term investments. The equity fund we have chosen for you is the Satrix 40 ETF, an index tracker fund that effectively allows you to invest in the largest 40 companies on the JSE at once. The price of the Satrix 40 ETF was R54.60 as at 31 December 2020 and R61.62 as at 31 March 2021, an increase of 12.9%. This is a large move over a 3 month period - let's look into some of what happened.

Time in the market is important

Although the markets showed a great return this quarter, there will be times when it does the opposite and falls dramatically. You then have to be patient and ride out the bad times so that you are there for the good times! This is why we suggest that you only invest in shares if you have a long term investment horizon. Nobody knows what the stock market will do so its best just to stick to your plan. Have a look at this article for some examples of people who kept going vs those that changed course.

So what happened then?

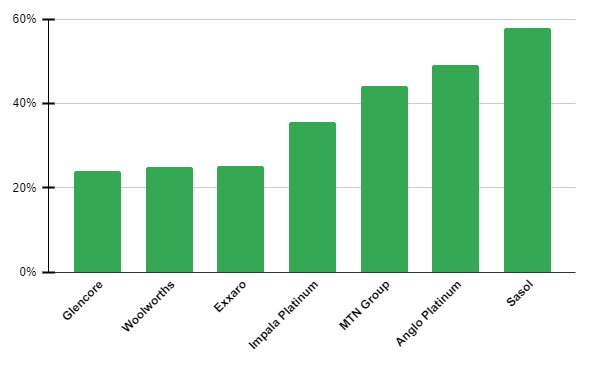

Naspers comprises around 21% of the Satrix 40 ETF and was up by around 17% for the quarter so made a sizeable contribution to the ETF's performance. Platinum mining companies continued their run as per Q4 '20 whilst some big names in Sasol and MTN which had taken big knocks in the recent past bounced back by 58% and 44% respectively over the quarter.

Winners

Platinum mining stocks performed very well in Q1 with Anglo Platinum, Impala Platinum and Northam Platinum going up 49%, 36% and 23% respectively over the quarter. One of the reasons for this surge was again that the price of rhodium and palladium, which are platinum group metals (meaning they are typically found in the same mineral deposit as platinum), shot up in Q1 given forecast supply shortages. Rhodium, palladium and platinum are used in vehicle catalytic converters in order to clean the emissions coming out of car exhausts. As emission regulations become stricter. so carmakers will need more of these metals. Shareholders are also expecting dividends from these platinum mining companies, another reason for the share price increase.

Sasol benefitted from the continuing oil price rally as some economies start to show signs of recovery. Sasol also delivered on their restructure plan (selling assets and cutting costs) exceeding shareholder expectations which makes its less likely they will ask shareholders for money (when a company is on the back foot and asks shareholders for money the share price normally drops - here the opposite happened).

MTN performed very well due to solid operational results in SA, Ghana and Nigeria. They also announced that they will sell down some of their assets (like cell towers) to generate cash and focus more on their core business.

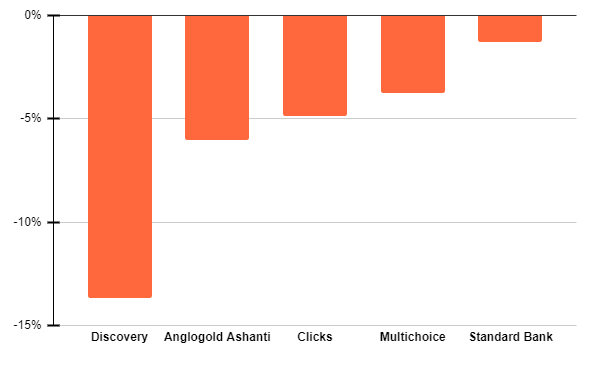

Losers

Only 8 of the shares in the Satrix 40 ETF fell in value over the quarter with Discovery being the biggest loser. One of the reasons for their share price falling is that the market was expecting the excess deaths from the 2nd Covid-19 wave in SA to expose insurers as possibly underestimating the full cost of the pandemic.

In spite of what has happened over the past 12 months or so, world equity markets are at or close to all time highs, including in SA. Just remember that investing is all about consistency and time - don't be depressed if prices go down suddenly, but also don't get too excited if they go up! Just stick to your well thought out plan!