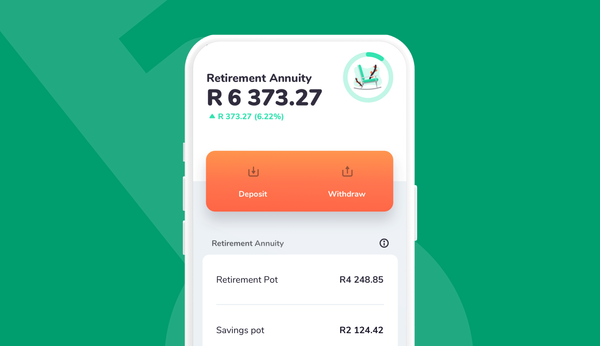

Many of us who are employed have some sort of retirement investment (I hope!). These can either be pension or provident funds where you and your employer contribute or a retirement annuity which is separate from any employment and is up to you to contribute towards.

What for?

If it wasn’t already obvious, the point of these investments is to allow you to have money to live off once you have stopped working and to supplement any passive income you may be earning in retirement. If you invest through Franc, our products are discretionary (non retirement investments) which will help you grow your wealth and allow you to potentially earn a passive income.

OK, what are my options?

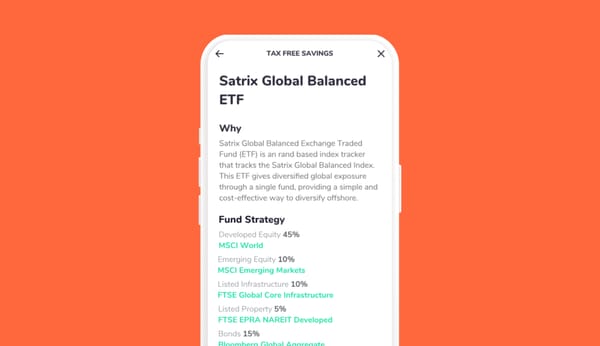

With pension and provident funds, where you can invest your money will be limited to the options your employer can provide you. With a retirement annuity you can choose which fund/funds to invest in as long as they are within the rules (for example you can’t have more than 75% in shares or 30% offshore).

If you leave your employer you can either move your pension or provident fund to your new employer’s fund, a retirement annuity or to what is called a preservation fund (where the investment can continue to grow but you don’t contribute any more to it). As always, make sure you check out the fees! And also, please try resist the urge to cash out your investment, you will be taxed and it will probably have a big impact on what you have left to live on in retirement.

Sounds taxing

Contributions to all 3 of these funds (in aggregate per year) are tax deductible in an amount up to 27.5% of your gross remuneration or taxable income (whichever is the higher) and with an overall limit of R350,000. This is a great incentive and was done to encourage people to invest towards retirement. Unfortunately less than 10% of South Africans can retire comfortably because they have invested too little. Investment returns earned on retirement investments are also tax free but SARS will get you eventually as we see later.

New rules

The main difference between pension and provident funds used to be what you could do with your money once you are retired. You used to be able to cash out your whole provident fund on retirement (not any more). Now pension and provident funds are effectively the same in that you can take a maximum of 1/3rd of your investment as a cash lump sum and you HAVE to use the remaining portion (“Balance”) to buy an annuity type product. If however your retirement benefit is R247,500 or less then you can take it all in cash. The same applies to a retirement annuity.

The rules were changed to stop people from cashing out all their retirement savings, blowing it and then having nothing to live off. If you had contributed to a provident fund before 1 March 2021 and you are 55 or older on that date (and stay in the same fund) the new rules effectively don’t apply to you. But if you are younger than 55 and have contributed to a provident fund, your retirement benefit will be split into 2 pots - one pot being the investment pre 1 March 2021 (including subsequent growth) where the old rules apply and the other pot being investments made after 1 March 2021 where the new rules apply and you HAVE to buy an annuity type product.

Annuity what?

Once you retire, you need to effectively exchange your balance for a future income or annuity (eg. you give a life insurance company R1m and they promise to pay you R6,000 a month increasing at 5% pa till you die, even if that is when you are 120) or you could take your chances with a living annuity where you can invest the Balance and then draw down on it (within certain limits) but then when it is finished, it’s finished. In the latter scenario though, if you die and there are still funds in the living annuity, it will go to whoever you have nominated as your beneficiary. In the first scenario, if you die after a few months, tough luck (unless you have bought a product that transfers to your spouse/family or is guaranteed for a certain period).

Scary reality

Obviously the higher your Balance the more you can get as a monthly pension (FYI the R6,000 a month per R1m is not that far off reality for a 60 year old male - also as a male you will generally get more than a female per month assuming the same Balance, as your life expectancy is less). Also if you decide to retire at 55 and not 60 you will get less per month as you will have longer to live (and your Balance will most likely be less than if you retired at 60). So if you as a 60 year old male wants to draw R30,000 a month (increasing at 5% pa) pre tax from your annuity you need around a R5m Balance at retirement. The income that you draw will be taxed as though you were working (over 65s and 75s do pay less tax though).

Now that you understand how all these things work, make sure you aren’t one of those South Africans who don’t have enough at retirement, start investing today!