Many of us have felt tired, worried and uncertain at some point in 2021.

If this is you, you are not alone.

But what does this have to do with investing?

Investors have long since recognised that biases may arise when making decisions or taking actions under pressure, when tired, anxious, and uncertain.

Maybe they can teach us something about making good investment decisions in these instances.

Maybe they can teach us how to sleep a little better at night.

As always, awareness is the first step.

The below are some (of many) biases that may creep into our investment decision making when we are not having our best days.

- Confirmation bias. I found an entry on Google that says so.

2. Information bias. I read all of the internet every night and refresh my investment page every few minutes, it is good to stay updated.

3. Loss aversion. I really hate to lose, even more than I like to win. So I put my money under my mattress, it is safest there (…inflation you ask?).

4. Group think. I mainly just watch others, I don’t have time to do my own research and thinking.

5. Restraint bias. I know I will put some of my salary into my investment account at the end of the month, of course I won’t spend it all (?!)

Do you recognise any?

If you answered no, then congratulations, you are have a rational economic mind.

If you answered yes, then — like me — irrationality can creep into your thinking occasionally.

But what can you do about it?

Here are a few points of advice from the experts, each of which may help with the above (and other) types of biases or less-than-helpful ways of thinking:

- Consider every decision in terms of importance and reversibility.

Investing for my future is important so I make it a priority to research this carefully.

I check what the correct facts are for accessing my money in case of an emergency.

2. Write down your goals in advance.

I will invest x amount each month this year, this is based on the budget I wrote down, specific to my life.

I will learn more about investing this year by reading those Franc Academy pages.

3. Know your main biases (and triggers to these) and write down rules of thumb.

Yes I saw that sale but then I saw my investment goals reminder and realised that those sales items are not actually a priority.

Someone said x (!), I took the week to think carefully about this and how it relates to my investing strategy, and what my own thoughts on the matter are.

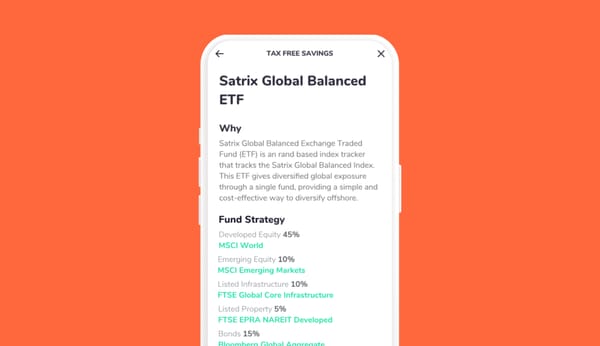

If in doubt, low risk investments with clear information make sense.

And you will unlikely go wrong with a small monthly investment that is automated and that grows quietly and strongly with no added stress whilst you get on with your life and work— and rest well at night!