Environmental, Social and Governance (ESG) investing has been around in some form or another for decades now (under a few different names). In the 1980’s, socially responsible investors excluded South African investments from their portfolio as a form of protest against the Apartheid regime. Today ESG is slowly solidifying itself as a common investment strategy so it’s high-time we did a deep-dive on what ESG means.

ESG covers many issues that should be considered when evaluating potential investments and there are 2 main reasons for its rise in popularity. Firstly, people are more educated and aware of the challenges society is and will be facing which makes them want to put their money into investments that promote sustainable practices. Secondly, it helps them determine the trajectory of the potential investment. If a company has unsustainable or unethical practices it may start affecting their profits and general standing so they may not be good long term investments (and here at Franc we are all about long term investments). Once you think about these factors it becomes mostly common sense for the more socially conscious investors.

Environmental Factors

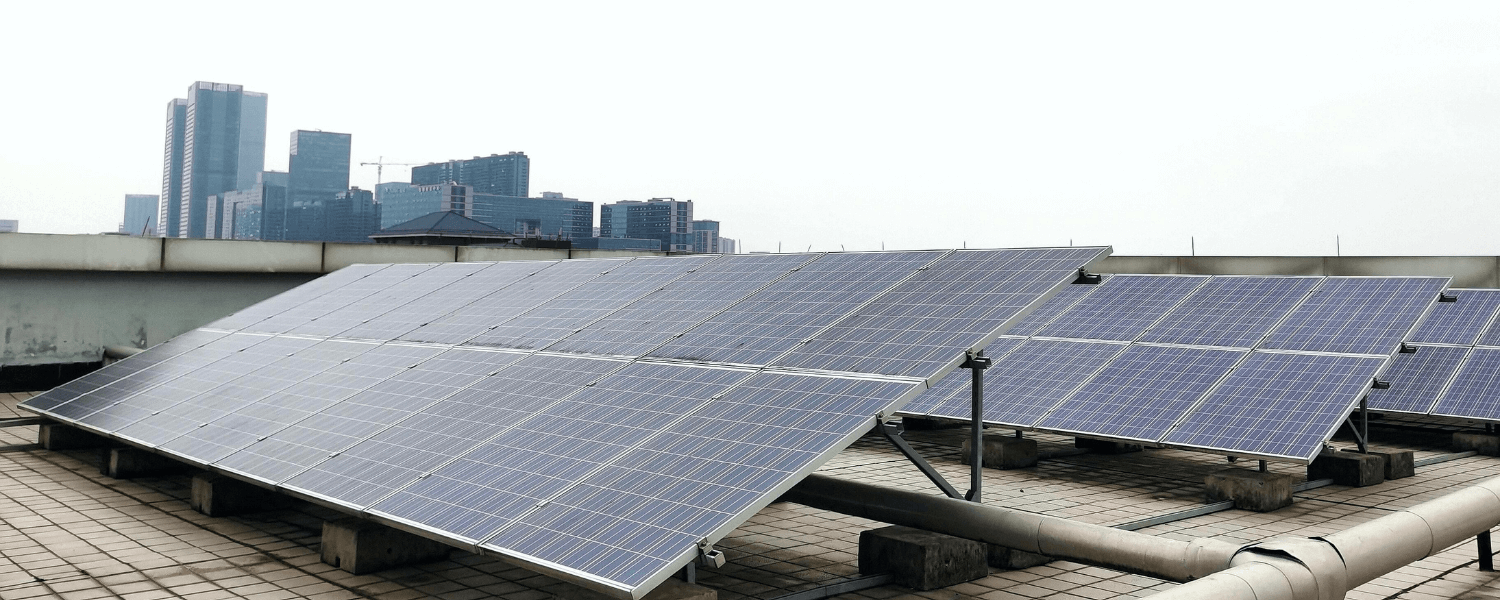

Climate change, the use of natural resources, pollution & waste and the opportunities a greener future creates are the key considerations. It’s 2022, so there are laws that companies need to follow surrounding their use of natural resources and pollution. However, anyone who is aware of the current trajectory of climate change knows that most big companies should be doing more to prevent climate change. To an environmentally conscious investor, a company who is going above and beyond to mitigate any negative effects their business has on the environment would become a more attractive investment. Beyond that, environmentally conscious investors recognise that there are so many opportunities in cleantech. Cleantech is defined as any product, service or process that reduces negative environmental impacts.

Social Factors

The social factors look at how a company treats all stakeholders. This includes their employees and whether or not they treat them well by providing them with a safe, healthy working environment and have proper management practices. For consumers, the concerns are around whether or not they are selling a quality product that does not compromise their safety or take advantage of them in some form. A current example of this are apps that collect and misuse data, even when there are clear regulations they should be following.

Franc as a company addresses these social aspects by ensuring that all of our users' data is secure and by educating our investors on how to invest in a financially responsible manner with things like our blog and our Academy. We know that good financial education is still relatively hard to come by.

Governance Factors

Governance factors are things related to the leadership and financials of a corporation. When evaluating governance factors you may ask yourself questions like, ‘Are the directors diverse?’ ‘Are the executives' salaries exorbitant?’, and ‘Does the company have a stable financial system with good accounting and tax practices?’ Taking into account factors like these ensures that you don’t land up supporting shady companies that are probably breaking the law. I don’t think that these really need that much more explanation.

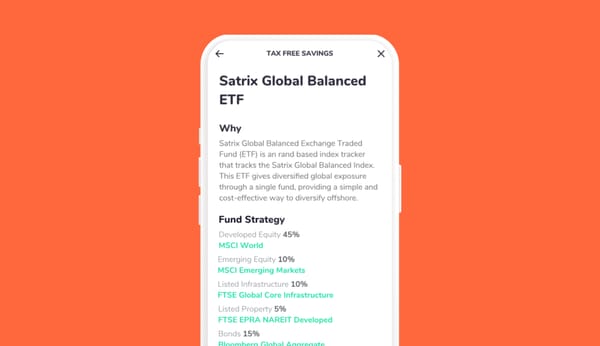

These are so many factors it can seem a bit overwhelming to introduce all into your investment strategy. Large investment firms who have jumped into ESG investing set their own list of ESG values to use when selecting the companies and funds they will invest in. Active retail investors can do the same, but for the more passive socially conscious retail investors it may be time to look into an ESG ETF and vote with your Rands.

![How & Why You Should Do a Financial Reset [+ downloadable financial reset journal]](/blog/content/images/size/w600/2024/12/Setting-goals-for-the-year.png)