Last month in the piece Losing Interest in Interest we talked about how the South African Reserve Bank (SARB) had cut interest rates this year in order to stimulate the economy. Last week the SARB decided to cut rates by a further half a percent. This means that the repo rate is now 3.75% and the prime lending rate is 7.25%.

The SARB realises that many South Africans have less money to spend as a result of Covid-19 and by cutting interest rates the loan instalments of people who have debt will also reduce. For many people who were really battling to make ends meet as a result of a loss of income these interest rate cuts are a godsend. Their monthly debt burden has kept coming down and this means they will have more to spend on things like food and healthcare.

How does this work?

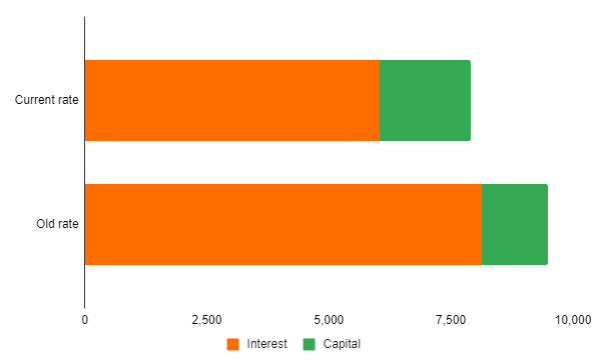

If you bought a home for R1m in February 2020 and you were lucky enough to receive a home loan at the prime lending rate (9.75% at the time) your monthly instalment would have been around R9,500. Now the same loan would only cost you around R7,900 per month as the prime lending rate has come down to 7.25%. This means you could potentially have another R1,600 in your pocket to spend on other things. If you really need to spend this extra money on essential items then go ahead. If however you can keep paying the old instalment of R9,500, you should definitely do so.

Why should I keep paying the same amount?

2 reasons mainly - if you do so you will pay off the loan much faster and pay much less in interest over the term of the loan. If you keep paying R9,500 you could potentially pay off your loan 6 years sooner than you would have if you cut your instalment to R7,900! Also by paying the higher amount per month you end up paying around R300,000 less interest over the term of the loan.

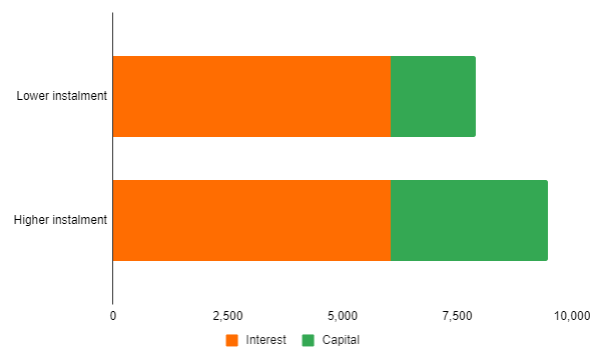

In the graph above you can see that when you pay your monthly instalment to the bank, at the beginning most goes towards paying interest and very little goes to actually paying off the R1m loan capital. In fact, after 5 years of paying R7,900 a month on your R1m home loan (R474,000 in total), you still owe the bank R865,000!

If however you keep paying the higher instalment you can see how much more goes towards paying off the loan capital - this is why you pay the loan off faster.

This type of thinking doesn't only apply to home loans - if your car loan or personal loan instalment has reduced you can also take advantage of this and ask the bank to keep your instalment unchanged in order to repay the loan faster (if there are no penalties involved).

Generally speaking, if you have debt (especially expensive credit card debt and personal loans) you should look to repay that as quickly as possible either through paying in more every month or using lump sums such as bonuses or 13th cheques to reduce the loan amount.

![The Guide To Provisional Tax In South Africa [+ downloadable provisional tax calculator]](/blog/content/images/size/w600/2025/09/calculating-your-provisional-tax.png)