True story. My friend Charlie, who just reached retirement age, started investing R40 a month in an equity unit trust when he was 20.

He kept that up for 20 years and then life got complicated so he stopped in 1995. But he didn't withdraw the investment.

Guess how much the investment was worth on Friday 5 June 2020?

R3.4 million.

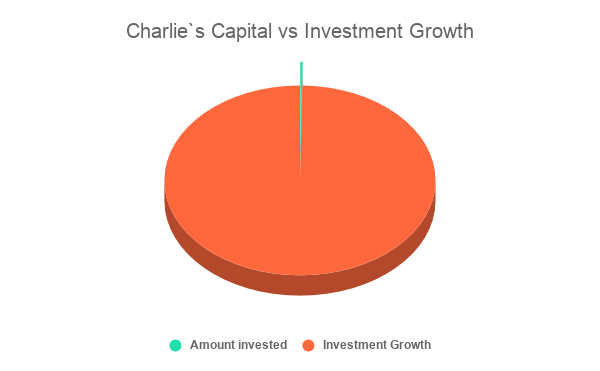

Hard to believe, right? He invested just R9,600 from 1975 to 1995 – R40 a month for 240 months – and then stopped investing for the next 25 years… and he's sitting on R3.4 million today.

The truly impressive growth you can achieve in the stock market is just one incentive to start investing young. We think there are at least seven good reasons to start saving before you start shaving.

1. It's habit-forming

The earlier you start, the more likely saving will become a lifelong habit.

Some things should be avoided even if your friends are doing them, like smoking, but some things are worth getting addicted to – and one of them is investing. And just like it's easier to stay in shape than to lose 5 kilograms at the end of each winter, becoming a habitual investor is actually easier than a stop-start approach.

2. Paying yourself first

Saving is sometimes called paying yourself first – putting money aside and getting it to to work for you before you spend it on other stuff.

If you do this young it's second nature by the time you have adult responsibilities. And believe it or not, it's often easier to find a few rands to save when you're young – your budget is less complicated and there are fewer demands on your wallet.

3. Coping with emergencies

Starting young gives you something to fall back on if the poop hits the fan.

Ideally, like Charlie, you don't want to draw against your investments, but if you have a real emergency it's better to raid your savings than take on debt. People with no savings often end up in a terrible debt cycle triggered by some misfortune or other. Investing when you're young means you can avoid the debt trap.

4. Getting the knowledge

Let's face it, it's hard to teach an old dog new tricks. It's easier to learn about investment when you're young – if you're still studying, your brain is in learning mode anyway. Getting to grips with a few investment fundamentals when you're young will pay dividends your whole life. Remember, life only gets more complicated as you get older. Imagine turning 30 and already being an experienced investor! Make it one of your hobbies.

5. You can take on risk

In the long run, riskier assets like shares give the best returns. But they do bounce around unexpectedly during the long haul upwards (Charlie has ridden out 10 crashes).

When you get older you can't take the chance of getting caught on the wrong side of one of the bounces, but when you're young all you have to do is keep investing and be patient. Having time on your side is a gift you only have when you're young.

6. Compounding, the secret sauce

The power of compounding is the whole reason Charlie has ended up with so much money – the longer you stay invested, the bigger the multiplier effect. The younger you start, the more time you allow for compounding to work its magic.

Incidentally, if Charlie had carried on investing R40 a month his investment would be worth about R5.3 million today.

7. Early retirement

If things go well, starting early could actually give you more years to enjoy yourself down the line. Consider this: if Charlie kept saving (instead of stopping after 20 years) and increased his monthly contributions by just 5% a year (ie, R42 a month in the 2nd year, R44.10 in the 3rd year, and so on), his investment would already have been worth R3.4 million 6 years ago.

Start Today

Whatever age you are, starting today is better than starting tomorrow. You haven't missed the boat if you're 30 or 40, but the sooner you start the sooner compounding can begin to work for you.

And if you're still a teenager, don't think you have to wait till you're 20!

Here's are two more numbers that will amaze you. If Charlie started saving at 18 he would have ended up with R5.3 million instead of R3.4 million at age 65 – even if he'd still stopped contributing at age 40. That's right – just R40 a month for two years at the beginning of his investment journey would have been worth R1.9 million at the end.

And if he'd started at 20 and carried on until last month with that 5% escalation? His investment would be worth R7.3 million.

Pay yourself forward. Be like Buffet – start investing today.