How do I start?

When you start your investing journey, you will need to make a few decisions - which platform to use, how often you want to contribute, what your investment goals are and then also you will need to choose how you want to invest your money (ie. what are you investing in?).

What you should be investing in will be impacted by a few things like your investment time horizon, your personal risk tolerance, your age, whether you need access to the money during the investment term and your personal financial situation.

For example, if you are building an emergency fund then it's not appropriate to have this be invested in the stock market which can be a bit up and down in the short term - you don’t want to have to pull money out just as the market drops. Similarly if you are investing for a long term goal like retirement then a money market fund would not be the best place to invest - sure, you get a return on your money that enables it to grow, but to really build wealth you need to be investing in a product that beats inflation comfortably (like the stock market).

Some people are also naturally more risk averse - they sleep better knowing that their money is not in an investment that can go up or down in the short term (even if they understand the pitfalls of not investing in something like the stock market to enable wealth creation). Whilst other people are naturally more aggressive and are willing to take on the appropriate risk.

So once you have decided where to invest your money, the next step is how - we will explore a few different strategies people use (these are applicable to long term goals).

Investment Strategies

Rand Cost Averaging 💸

This is just another way of saying you make regular (monthly/weekly) contributions into your investment account (specifically buying into priced instruments like shares, unit trusts and ETFs).

Given that you are making regular contributions, each time you invest you are buying the product at a different price - as an example if you have R1,000 and you are buying a share at R100/share - you can buy 10 shares. If the next time you buy the same share, the share price has dropped to R50, your R1,000 now buys you 20 shares. So over the 2 periods you bought 30 shares at an average of R66.66. So although that large drop in price wouldn’t have looked good, it did enable you to get in cheaper the second time. And as you continue to buy, you average out the cost of your investment.

Buy and Hold 📈

Another way you could invest is kind of the opposite of rand cost averaging. This is when you buy and hold. This means that you invest in more lump sum fashion - so like the above scenario let's say you had R10,000 to invest and bought the same shares at R100 each. Then suddenly the share price dropped to R50 - your investment value would halve. That’s why some people prefer buying a bit at a time so that if markets do collapse, they benefit from buying in at lower prices subsequently. The counter view is what happens if the market rises suddenly - maybe your R10,000 becomes R15,000 and if you tried to average in you would be buying at a higher price going forward.

Index investing 👨💻

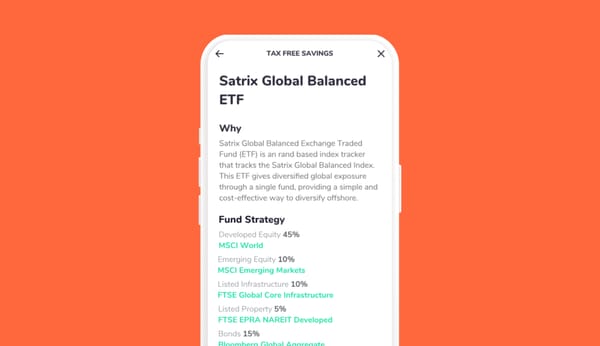

Index investing is when you don't try to choose which specific stocks to buy yourself or you don't invest in products where there is a fund manager who is actively choosing what stocks to buy. You invest in products that are representative of the entire market or a large sub section of it. For example the Satrix 40 ETF and Sygnia Itrix S&P 500 ETF are both examples of index investing - you are buying into the shares that make up this index.

This has shown to be a smart way for any type of investor to invest given the low fees and often similar (if not better) performance versus actively managed funds.

Core-satellite 📡

Core-satellite splits up your strategy into 2 parts - the “Core” element is investing in low cost index tracking funds whilst the “Satellite” part gives you some licence to choose some shares/products of your own if you feel a bit more adventurous. Some people may want to hold a few shares like Apple, Tesla or MTN directly (but keep most of their money in ETFs) and would then potentially buy into this investment strategy.

Choose what’s best for you

So once you have decided to start your investment journey and figured out what your long term goals are, see which ones (or combinations) of the above are most suitable for you - are you the set and forget type (rand cost averaging/buy and hold/index investing) or do you want to play a slightly more active role in managing your money (core-satellite)? 🤔